- June 15, 2023

As “stay-at-home” orders are extended due to the COVID-19 Pandemic, people all over the globe have changed their spending habits. In times when the ability to spend is restricted, economic activity often slows.

When spending slows, the Federal Reserve typically steps in and lowers interest rates to help stimulate the economy. As “The Fed” announced it would cut its target interest rate to zero in March, rates on personal loans and mortgages declined in concert. As with many things in life, we can find opportunities amidst a storm.

As I write this post, rates on 30-year mortgages are hovering between 3.5 and 3.25 percent. For those who purchased a home within the last decade, current rates may provide an opportunity to lock in a lower rate and save interest over time.

Should I Refinance?

Interest rates are as low as they’ve been in recent history, and questions about them are becoming much more prevalent – “Should I refinance?” “What term should I choose?” “Should I pay out of pocket or bundle the costs into the loan?” As you can imagine, the answers to these questions are circumstantial, and largely depend on your situation and goals.

A Case to Consider

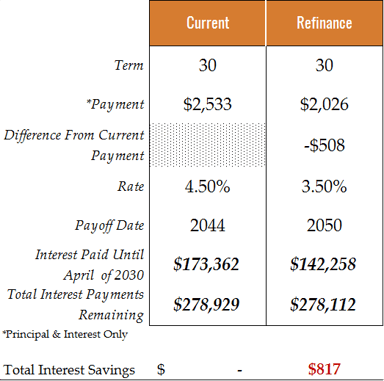

As some “food for thought”, consider the case of a couple who purchased a home for $625,000 in 2014. After putting 20% down, they obtained a 30-year, $500,000 mortgage, at 4.5% interest. They decide to refinance to lower their monthly payment.

The cost to refinance is 2% of the remaining mortgage balance (which in this case is ~$442,000). After rolling the refinance costs into the loan, they apply for a final mortgage of ~$451,000. You can see the details on their new payment and total interest costs below…

If freeing up excess cash flow each month is their goal, a refinance certainly helps achieve this; however, despite the lower rate, the term on their mortgage becomes extended, and accrues more interest over the entire life of the mortgage. However, if they were to target selling their home within the next 10 years in anticipation of downsizing or relocating, more than $30,000 of interest can still be saved from pursuing a refinance.

The Payment Remains the Same

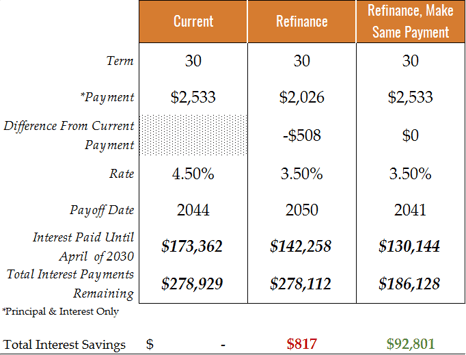

Consider if this couple was able to make the same mortgage payment after they refinance – They build equity more quickly and save a substantial amount in interest in the process. The table below shows how much interest can be saved by effectively “pre-paying” their mortgage by making the same monthly payments as they were prior to refinancing.

In this scenario, the couple could save over $92,000 of total interest by making the same monthly payment and own their home 3 years sooner. As they pre-pay and build equity more quickly, they give themselves additional flexibility down the line if a major home improvement project is needed.

The Shorter the Loan, the Sooner You Own

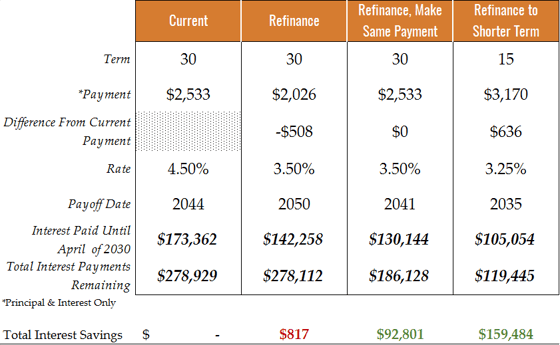

When it comes to investing, the longer the investment term, the greater the effect compounding has on your returns. Since most of the interest is paid on the front end, the opposite is true with a mortgage. Reducing the term on your mortgage allows for considerable interest savings and brings you closer to outright ownership of your home in half the time, but a shorter term isn’t always the best fit – it depends on your situation and goals.

Maybe your household income has increased from the time your home was purchased and you feel confident you can absorb the extra payments. Perhaps you are targeting a career change in a few years with lower earning potential or are nearing retirement and would like to eliminate your mortgage beforehand. You may simply be uncomfortable with debt and would prefer to be “debt-free” as soon as possible. All these reasons could serve as justification to pursue a shorter mortgage term when purchasing or refinancing. You can see the effects a shorter term has on interest costs below…

While this option does produce the greatest cost savings, it also provides you with the least amount of flexibility as it relates to your monthly mortgage payment. In the event of a sudden job loss or disability, paying your mortgage becomes that much more challenging.

For those who purchased a home within the last 10 years, congratulations! By historical standards, any rate south of 6% is extremely low. Especially when compared to those of the early 1980’s (see below for the peak at nearly 19% in October of 1981)!

Everyone’s situation is different and making decisions completely by the numbers isn’t always the best way to proceed. Before taking the plunge, take all your goals into consideration both short, and long-term.

Thanks for reading and be well.

Matt Weier, CFA, CFP®

Partner

Director of Investments

Chartered Financial Analyst

Certified Financial Planner®