- June 15, 2023

Is it a good time to invest in the stock market? Is the bear market over? If I don’t invest now, will I miss out on gains? If I do invest now, will the market dip again?

These are all natural questions to ask when investing.

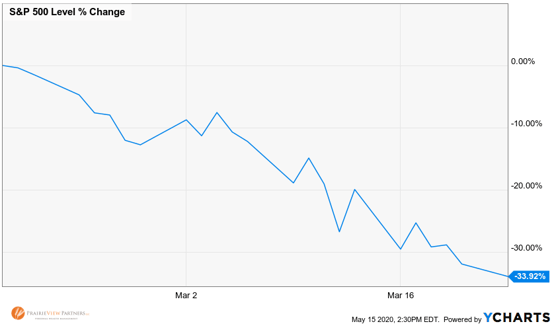

Recent market volatility has caused many to question whether it is an appropriate time to invest. This comes as no surprise given the S&P 500 dipped 34% from its peak on February 19th to its low on March 23rd. (see Chart 1)

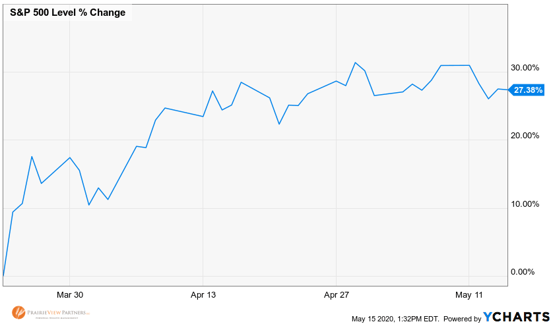

The challenge with waiting for volatile markets to pass is that by the time you perceive it is “safe” to invest, you have most likely missed a good portion of the recovery. As shown in Chart 2, since March 23rd, the S&P 500 rose 27%, but it certainly hasn’t been a smooth ride up.

What does an investor do when it is clear that trying to time the markets is incredibly difficult, if not impossible? You rely on a strategy called Dollar Cost Averaging (DCA).

Dollar Cost Averaging involves investing a specific dollar amount at regular intervals over a period of time. A common example is how you make contributions to your 401(k). Upon starting a new job, you choose a portion of income to be deducted from each paycheck and invested in a retirement account. Knowingly, or not, you are participating in Dollar Cost Averaging!

DCA is a useful tactic to help facilitate investment during uncertain times. Let’s imagine you inherit $100,000 from your favorite bachelor farmer uncle. You consider investing it; but stock market volatility leads you to believe now is the “wrong time.” Your thought process might be: Once things settle and become stable; I will invest. Yet, as we saw in March of this year, waiting for calm waters is a recipe for missing the boat. Read this if you’re hoping for the market to tell you it’s clear to invest.

Humans versus Math

To be sure, DCA is not necessarily a return maximization strategy. In fact, the math of past market experience shows that most of the time we would be better off investing an entire amount immediately.1 However, the fact remains that we are human and prone to question our choices and make investment decisions based on fear, greed, “gut feel” or other, less mathematically inclined, reasons.

Dollar Cost Averaging allows us to participate in long-term growth from stocks without having to face the market head-on. It can help take the emotion out of the investment equation and keep us focused on investment goals rather than short-term market swings.

Let’s take a look at how this might work. Rather than investing $100,000 today, you can invest $10,000 each month for 10-months. Alternatively, you can invest $5,000 each month for 20-months. The main point is that within a reasonable amount of time, the entire amount is invested and you’re in a position to take advantage of stocks’ long-term return potential.

Parting from smaller, specific amounts at regular intervals can cause less doubt or feelings of regret if stocks take another dip than doing it all at once.

“How do you eat an elephant?”

“One bite at a time.”

If market volatility causes you to question whether or not any particular moment is the right time to invest (answer: it’s always the right time to invest when you have a strategy, a clear understanding of your goals, and a long-term outlook), consider Dollar Cost Averaging. Like setting your 401(k) contributions on autopilot, it can be an effective tool to take advantage of market growth, while not placing all your chips on the table at once.

Sources:

1Vanguard, “Invest now or temporarily hold your cash”