- November 20, 2024

In the late 1990s, early 2000s, a problem had begun to simmer in the US. It was not the advent of MTV, fervor of Y2K, or overvaluation of tech stocks. No. The cost of medical care was skyrocketing.

To fight this financial burden, lawmakers took up hammer and anvil, and forged the Health Savings Account (HSA).

What is an HSA?

An HSA is a tax efficient savings vehicle used to pay for medical expenses. Think of it as a piggy bank for doctor’s visits, medications, physical therapy, etc.

How is it tax efficient?

The Triple Tax Advantage

- Pre-tax Contributions – If your salary is $50,000 and you contribute $3,000 to an HSA, you do not pay taxes on the amount of your contribution, i.e. you are taxed on $47,000 rather than $50,000.

- Tax-free Growth – The yearly dividends, interest payments, and investment gains you receive? Not taxed! Over the long-term, that makes a difference.

- Tax-free Withdrawal – Provided you use the funds for qualified medical expenses, you will never pay taxes on the withdrawals. Even for 401(k)/IRA savings, you pay taxes on withdrawals. This unique feature makes HSAs stand a head taller than your average retirement account.

Note 1: Some employers contribute to HSAs on behalf of their employees. These contributions are also not taxed.

Note 2: While HSAs have many tax advantages, one drawback is that if an account owner dies and the assets transfer to a non-spouse, the whole amount is taxable in the year of death, which could lead to a tax burden for the beneficiary.

Can everyone contribute to an HSA?

Unfortunately, only those enrolled in a High Deductible Health Plan are eligible to contribute. If you qualify for Medicare, are claimed as a dependent on someone else’s tax return, are covered under a Health FSA/HRA (unless limited-purpose or Retirement HRA), or receive non-preventative care benefits before reaching the deductible, you also cannot contribute.

Should I enroll in a High Deductible Health Plan in order to contribute to an HSA?

The answer depends on your unique financial situation. However, here are some things to think about:

- Income – Those with high income (and thus in a higher tax bracket) would save more on every dollar contributed to an HSA than someone in a lower tax bracket.

- For example, if you pay 40% in taxes, then, by contributing $3,000 to an HSA, you save $1,200 ($3,000 x 40%).

- However, if you have a lower income and pay 20% in taxes, then, by contributing $3,000, you only save $600 ($3,000 x 20%).

- In other words, those in a higher tax bracket have more of an “HSA incentive.”

- Health – For those in good health and not expecting large medical expenses, enrolling in a High Deductible Health Plan and participating in an HSA might be advisable. You’d get the tax savings and pay less in premiums. However, if you expect to pay a lot of health expenses, then you might want to stick with a low deductible plan.

Note 1: High deductible plans have lower annual premiums because insurance starts paying for expenses at a higher threshold than a low deductible plan. For example, a high deductible plan might cover costs after you spend $3,000, while a low deductible plan might cover costs after paying $1,000. If you want coverage to kick-in earlier, you pay for it!

Note 2: If you are considering enrolling in a High Deductible Health Plan, make sure you have an adequate Emergency Fund in case of big, unexpected medical expenses. A surprise hospital visit can cost thousands of dollars.

Why are HSAs great?

- Accumulation – HSA balances roll over from one year to the next. This differs from the “use it or lose it” Flexible Spending Account (FSA) where balances return to $0 at the end of the year, even if you still had money leftover in it.

- Portability – This means that the HSA account is 100% yours. If you switch companies, retire, quit, etc. you still take the funds with you.

- Retirement Living Expenses – After turning age 65, you can use HSA money for non-medical expenses without penalty. This means that it essentially becomes a 401(k)/IRA—it is funded with pre-tax dollars, grows tax-deferred, and when withdrawn is taxed as ordinary income. If you do not want to pay any tax at withdrawal, then just use the funds for qualified medical expenses!

How much can you contribute to an HSA?

The maximum 2020 contribution is $3,550 (individual) and $7,100 (family). However, people age 55+, can contribute an additional $1,000/yr.

The maximum includes employer contributions, e.g. Dancing Bear, Inc. contributes $1,000 to Jerry Garcia’s (age 30 and single) account, so he can only save an additional $2,550 ($3,550 – $1,000 = $2,550).

What if I have enough income to cover medical expenses and want to use my HSA as a savings vehicle?

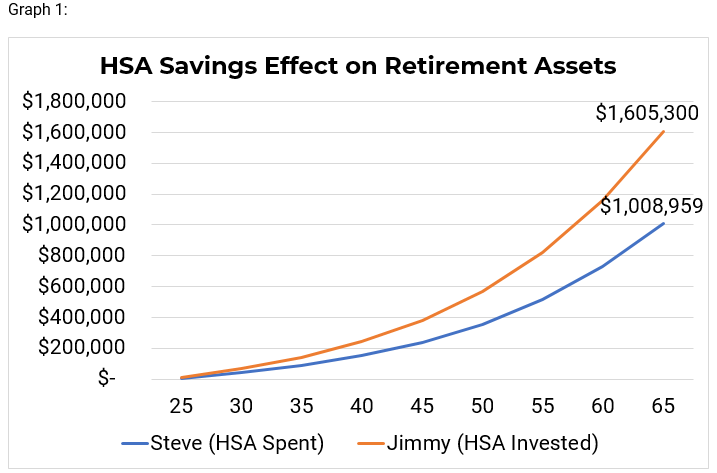

Because HSAs are tax efficient, it is a terrific way to save for retirement expenses. Graph 1 shows the power of HSA savings over time. Steve (blue line) and Jimmy (orange line) are both single and maximize IRA and HSA contributions from age 25 to 65. However, each year, Steve uses all his HSA funds for medical expenses, while Jimmy does not touch the savings. By age 65, Jimmy has ~$600,000 more of assets than Steve!

This is not to say that HSA funds should not be spent during your working life. Rather, if you do not need to tap into the savings, it can provide you with tax-deferred growth.

What should I do with the funds in the HSA?

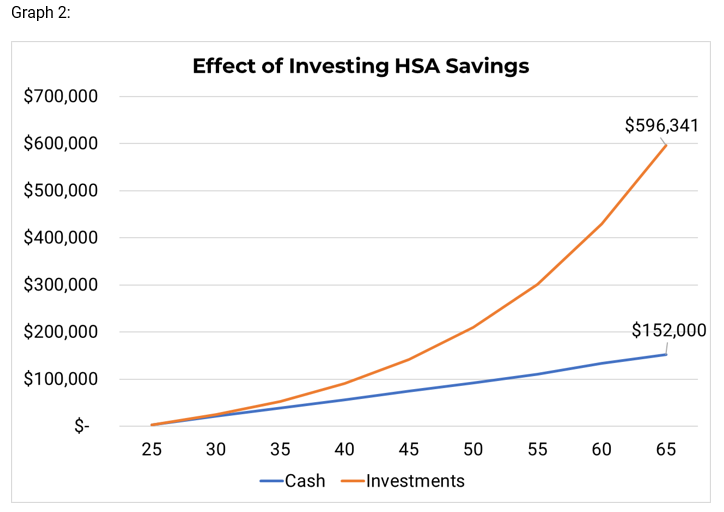

Let us not forget about Einstein’s 8th Wonder of the World: Compounding. In many plans, you can have savings in cash or invested in stocks and/or bonds. Graph 2 shows that if Jimmy chooses stock over cash, he could accrue an additional ~$450,000!

Note: If you know you will need funds in the short-term for medical expenses, it is a good idea to keep that amount in cash. This way, on the date you need it, you will not be affected by the ebb and flow of the stock market. It may make sense to keep an amount equal to your annual deductible in cash.

If you are thinking, “Wow! HSAs sound great! What do I do next?” You can:

- Check to see if you are enrolled in a High Deductible Health Plan. If you are, maximize annual contributions. If your employer contributes, take advantage of it.

- Invest the balances. If you don’t need the savings for short-term expenses, allow your money to work for you and grow tax-free.

If you have additional questions about HSAs and how they relate to your unique financial situation, please do not hesitate to reach out to us. We are here to help in any way we can. Thanks for tuning in.