- July 8, 2025

Financial markets have a certain way of humbling investors from time to time. The last three years have been a prime example. One could be forgiven for assuming that a once-in-a-hundred-year pandemic that halts a global economy would lead to a prolonged bear market. It lasted five months. Or, assuming that as said pandemic faded the good times would continue. With the job market at historic strength and corporations minting earnings at the end of 2021, it seemed like a reasonable assumption. As we learned during 2022, that was most certainly not the case.

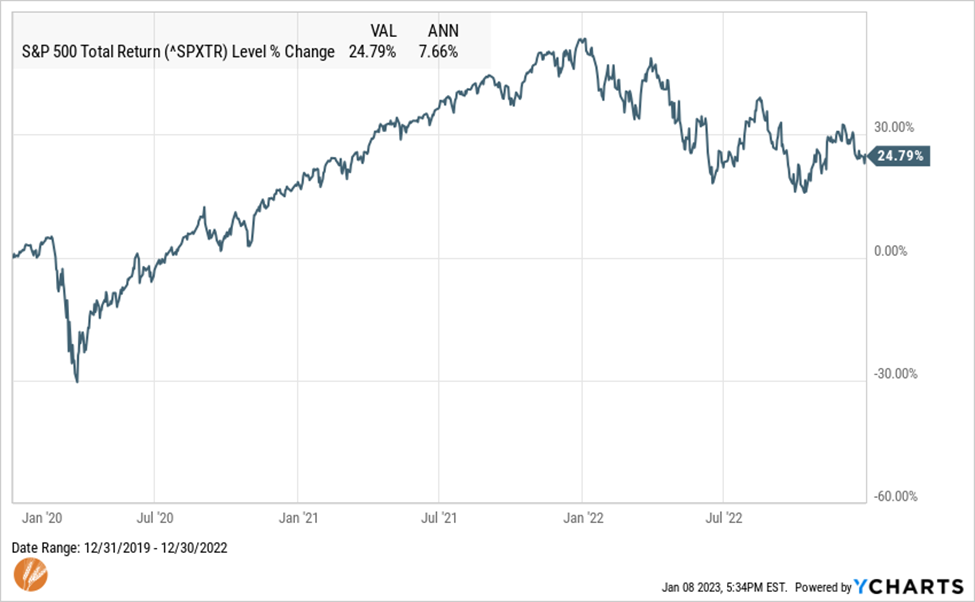

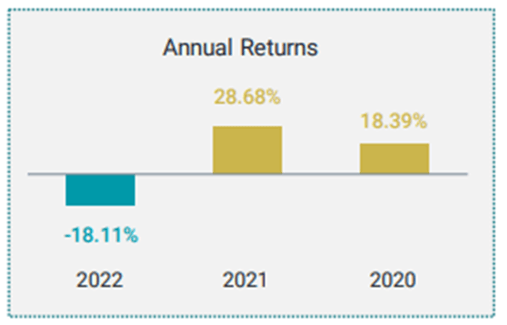

But surely two bear markets in three years – we’ve historically seen one every five to six years – would lead to negative total returns for stocks for those three years. Not so fast! The years 2020 – 2022 ended with average annual returns of 7.7% for the S&P 500, including dividends. Not outstanding, but good enough to be better than about a third of all rolling three-year periods. Given the circumstances, I’ll call that a win.

Watch the video below for a discussion on additional stories and charts from 2022!

Returns Don't Tell the Whole Story

Economic and geopolitical events of 2022 aside, it’s reasonable to justify a weaker performance since the preceding two years were so strong. And those years were also preceded by a 31% return in 2019.

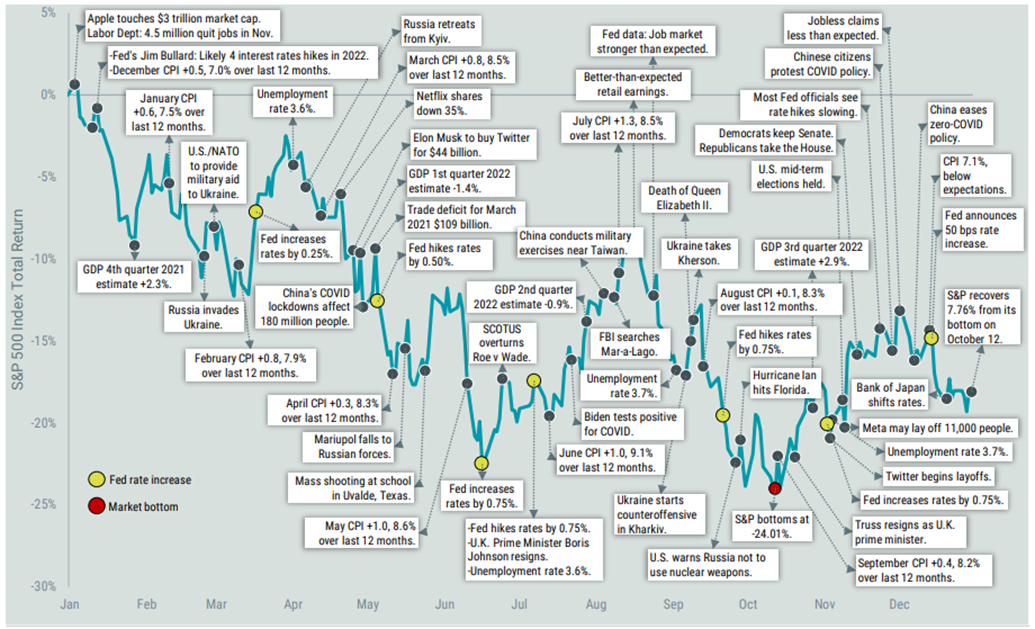

Considering the economic and geopolitical events of 2022, it becomes even more understandable that 2022 would have seen weak stock returns. We can now make this observation with the benefit of hindsight. Investors didn’t know going into 2022 that Russia was going to invade Ukraine. Or, that the Fed Funds rate would finish the year at 4.5%, nearly 4x their predicted level of 1.2%.

All of this to say that it is very difficult to make investment decisions based on a current economic environment or forecasts about the future. Decisions based on the current environment will tend to extrapolate the present into the near future. At the beginning of either 2020 or 2022, it would have been understandable to extrapolate relatively sanguine economic environments into those years.

While the difficulty of accurately forecasting the future is well documented, every now and then, either through luck or astuteness, an event or situation can be accurately forecasted. However, the market’s reaction or interpretation of that event can be a different prediction altogether. For example, say in the early days of February 2022 one foresaw the events unfold in Ukraine. They then invested in oil futures, predicting that the events would trigger a surge in prices. In reality, after a brief run up in price, this investment would have closed 2022 with a net loss.

A successful investment based on forecast requires two right answers – the event or situation and the market’s response. Only with the benefit of hindsight do the events and the market's response seem obvious. But also, with the benefit of time, singular events that influence markets in the short-term fade and give way to the primary drivers of long-term stock returns – earnings and dividend growth and valuations.

The legendary investment researcher, Jeremy Siegel of the Wharton School of Business is best known for his book “Stocks for the Long Run.” In the book he chronicles the wealth creation of common stocks relative to other investments and various economic and business cycles over long-term periods going back to the 1880s. The first edition of the book was published in 1992 and he found that for the previous 110 years the real (after inflation) return of a diversified portfolio of common stocks was 6.7% per year. He published the 6th edition of the book in 2022 and found that in the ensuing 30 years, the real return for stocks was again 6.7% per year through 2021.

It may be an understatement to say that during those first 110 years, and the more recent 30-year period, there were many events that temporarily derailed the advancement of stock returns. Most events that drive headlines, or short-term market fluctuations, have no impact on corporations’ ability to earn money.

Gradually, then Suddenly

Every so often a trend continues in markets just long enough where it becomes commonly accepted that it will continue forever. Consequently, the particular investment strategy that runs counter to that trend is thought to be a thing of the past. The best example of this may be BusinessWeek’s cover story in 1979 proclaiming the “Death of Equities.” Less than two years later, stocks began one of the longest bull markets in history.

Often, by the time these conclusions are drawn and statements made, something has already begun to change in markets that goes unnoticed by the casual observer. In Ernest Hemingway’s The Sun also Rises, a character is asked how he went bankrupt, to which he responded, “Gradually, then Suddenly.”

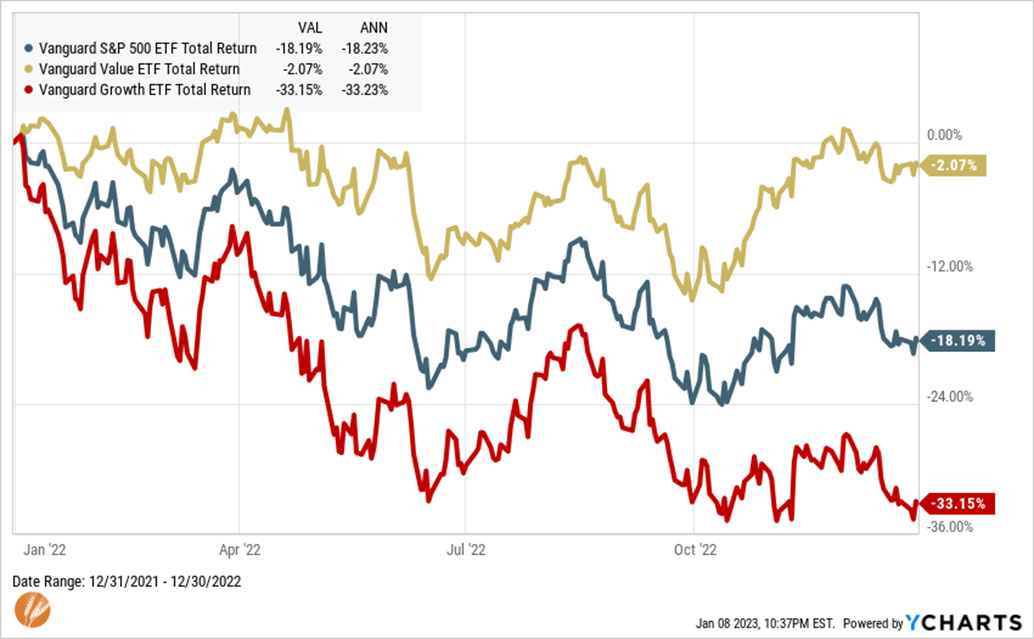

For most of the time since the Great Financial Crisis, “Growth” stocks (stocks with high valuations relative to earnings) have performed better than “Value” stocks (stocks with low valuations relative to earnings). This trend was counter to most investment timeframes and in recent years “value” investing had been all but declared dead, akin to stocks in 1979.

But this trend began to quietly reverse in 2021. While the S&P 500 continued to make new highs during the second half of 2021, most of the biggest “growth” names (Tesla, Meta, Amazon, etc.) had actually been in decline since early 2021. “Value” stocks had quietly been propping up the S&P 500 for most of the second half of 2021. This quietly continued in the first part of 2022 only to accelerate in the second half of 2022 catching many, who had eschewed “value” in favor of “growth,” off guard.

By the time the books were closed on 2022, “value” was down only 2% for the year compared to down 33% for growth – a spread only paralleled by the bursting of the dot com bubble 20 years ago. And now “value” has the edge over the last three years and they are virtually tied over five years.

None of the preceding is intended to conclude that one category of stock is superior to the other – quite the opposite. It should provide further evidence that even in years when stocks are broadly lower, that diversification can help our returns, as was the case with 2022. And, even when a particular type of stock begins to be perceived as superior to others, changes in market dynamics can gradually begin to shift and then suddenly it seems obvious.

2023 Market Environment

These posts are always prediction-free, but it is worth taking stock of the present environment to put things in perspective. It may seem as if we are in a new investment environment. That may be true relative to the last several years, which saw near-zero interest rates, above average stock valuations, the emergence of digital assets, and troublingly low inflation. Many of these factors combined to give markets an artificial mispricing of risk. But in many respects, the current market environment is more “normal” than it may feel or than what is conveyed in the media.

So, here is a series of illustrations that shows where financial markets stand as we start 2023.

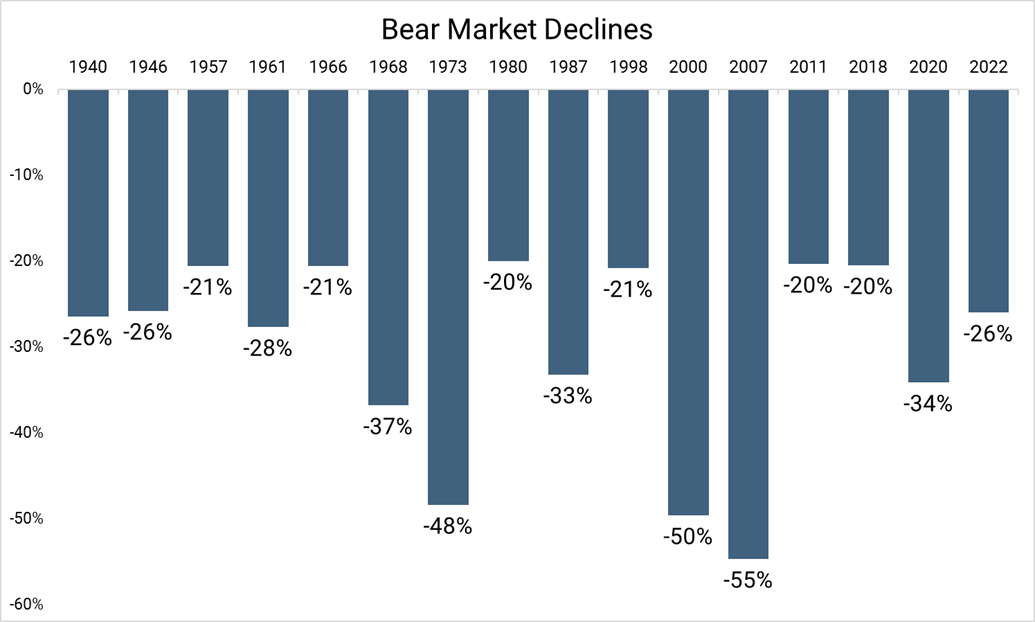

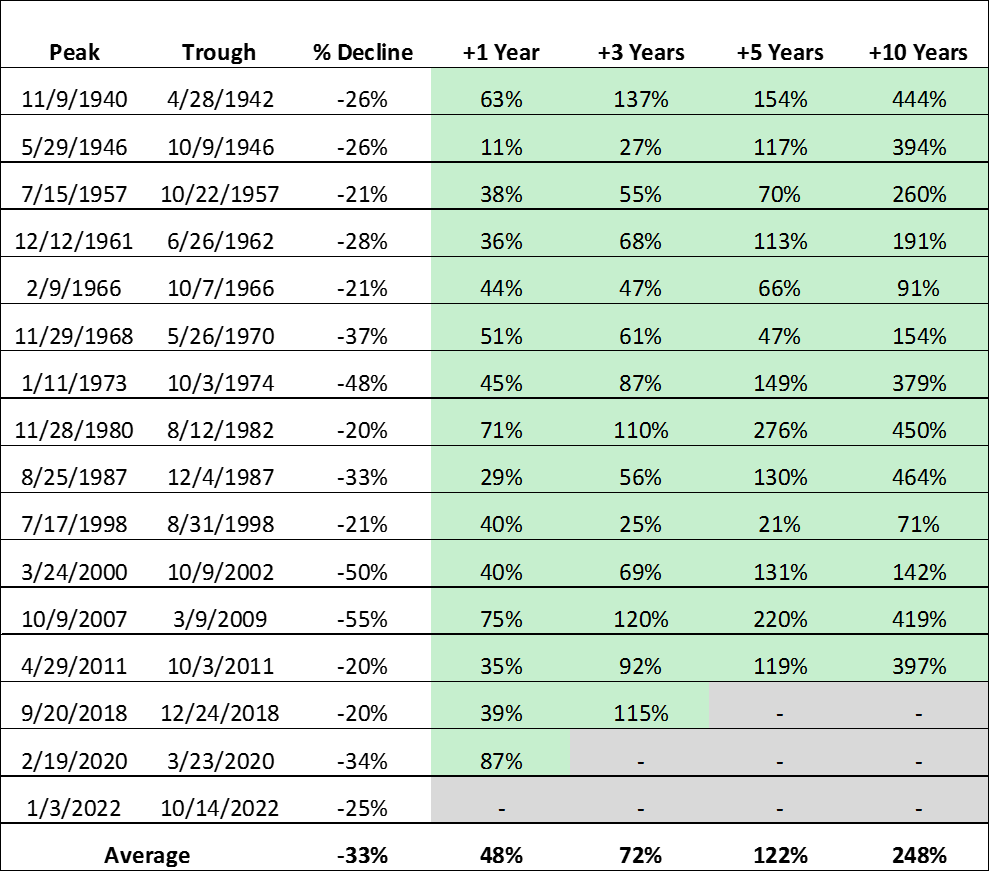

We’re still in a bear market, but we’ve seen this before – 15 times before the one that started in 2022.

And every one of them has seen robust recoveries.

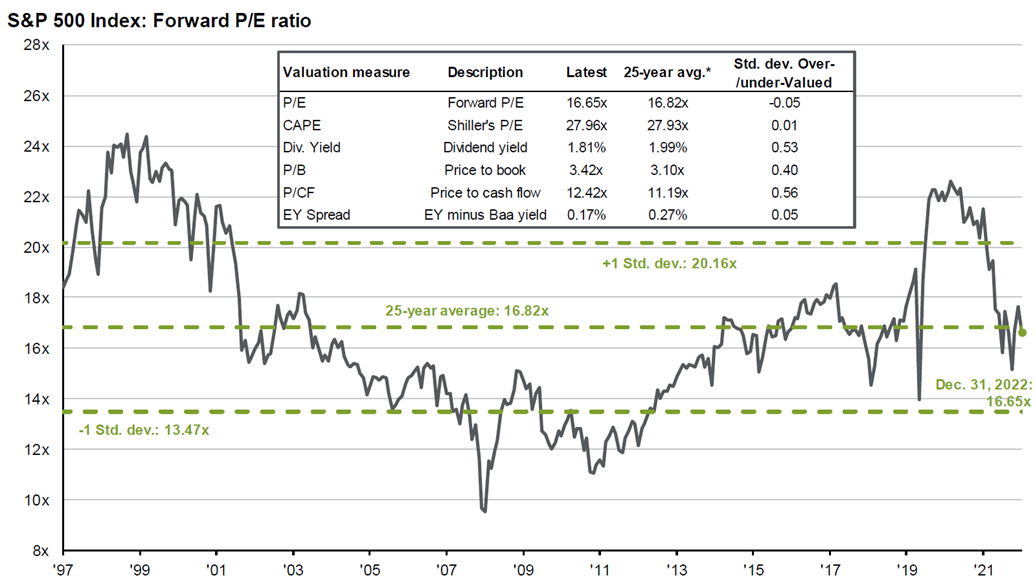

S&P 500 valuation metrics are about as close to their 25-year averages as could be expected.

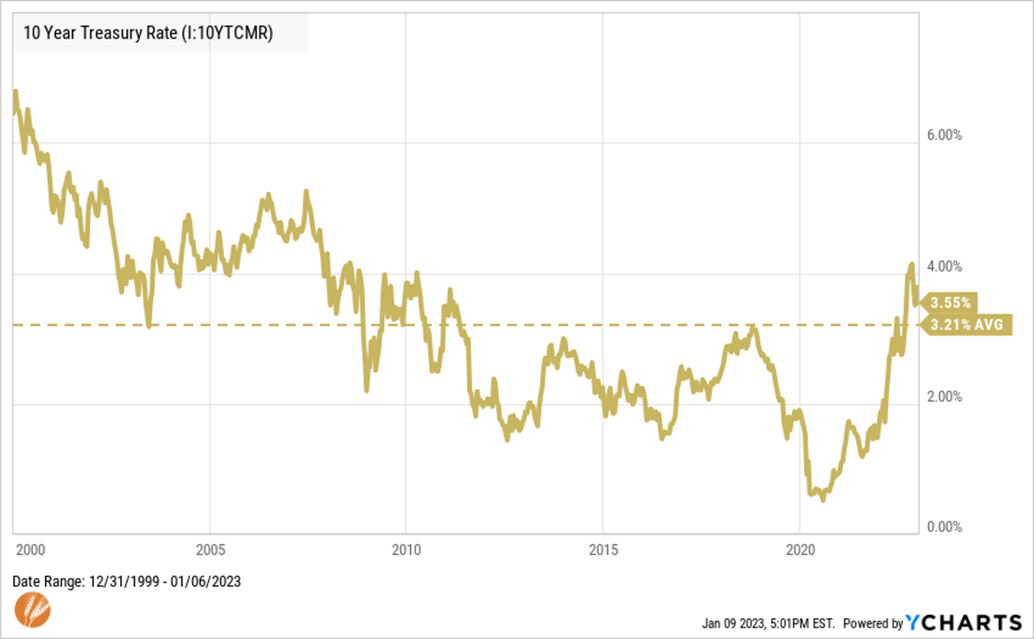

Interest rates are now more in line with historical norms than they have been in years.

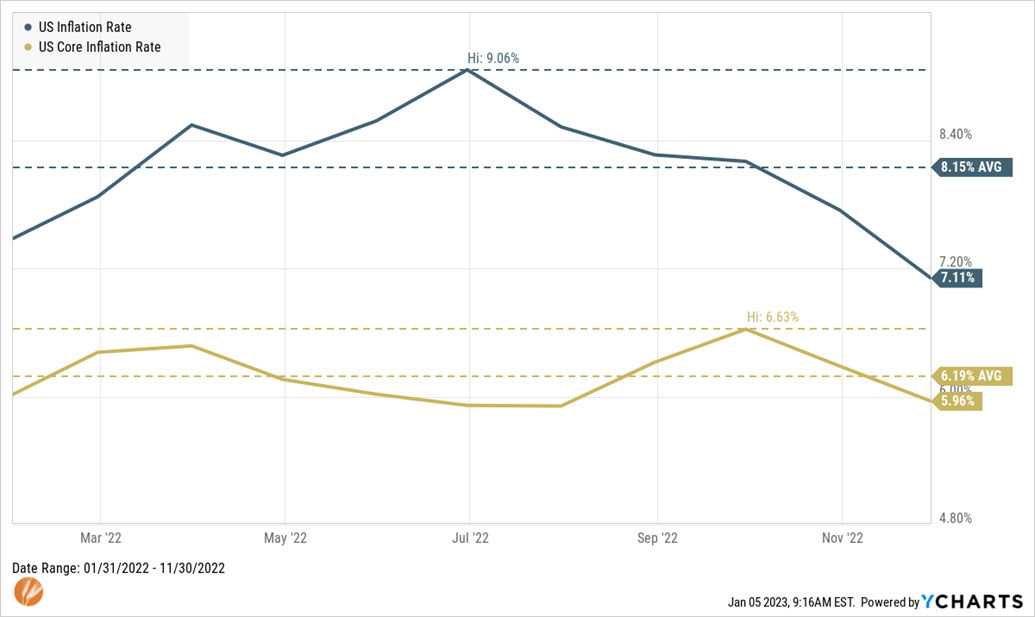

Inflation is still above where the Federal Reserve would like it to be, but it has been falling consistently in recent months.

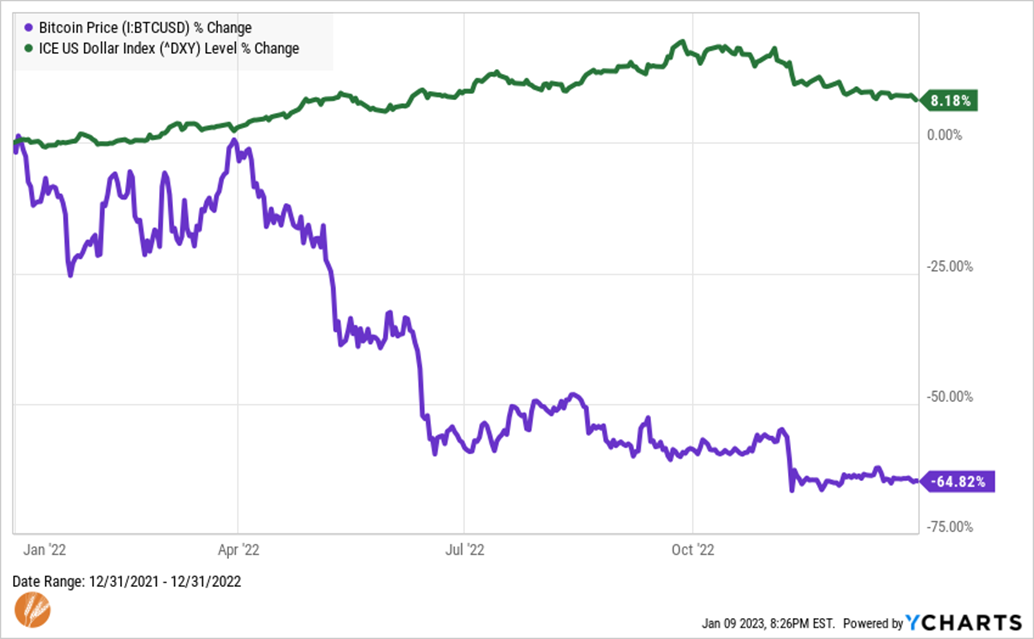

Digital assets didn’t quite live up to their hype – particularly for their hoped-for abilities to hedge inflation or counter a “devalued dollar.”

Despite still being in a bear market for stocks, it’s reasonable to conclude that markets are more accurately assessing investment risk and again placing emphasis on what have historically been the primary drivers of long-term return. While healthy for markets, it certainly doesn’t make bear markets any more enjoyable, but a key assumption of your financial plan is that bear markets will happen.

In strong or weak market environments, basics such as diversification across markets and an asset allocation that reflects your plan are most important to your success – especially when it begins to be said that those are no longer important.

Wishing everyone a happy, healthy, and successful 2023!

Thanks for reading.

Matt Weier, CFA, CFP®

Partner

Director of Investments

Chartered Financial Analyst

Certified Financial Planner®