- April 8, 2025

It seems like every day we’re told about something new that should matter to us. We’re told that these things are unique to our times, deserving of our precious time and attention, and require action.

There certainly hasn’t been a shortage of topics that seem to matter. We hear about the Trade War and Tariffs, the next election cycle, and where interest rates might go from here. We’re told that the unemployment rate is at a historic low point, but wage growth is slow and recently the word Recession has re-entered the conversation.

To be sure, these are important topics from the perspective of being an informed citizen of a free and open society. But when it comes to the achievement of our own financial and life goals, they are nothing more than distractions.

Great things are happening…

In the last three months, readers of this page have accomplished great things despite those distractions. They have retired from successful careers, started new jobs and careers, and sold businesses. They have purchased and sold homes and cabins and experienced once in a lifetime vacations. They have welcomed new members to their families saw children and grandchildren start and graduate from college. These are the things in our lives that really matter, are deserving of our precious time and attention, and require action!

The one thing that all those achievements had in common was that none of them was made possible by what was in the morning news or by attempting to predict what might be in the morning news a few weeks or months later. They were made possible by careful attention to what was important to the individual and planning for the goal to be accomplished.

Is a recession coming?

Let’s consider one of the more recent concerns we hear about – that there is a recession looming because it’s been so long since the last one – and start by answering some basic questions. This example can play two roles if we substitute the word “recession” with “bear market” and the conclusions are the same.

Will there be another recession?

Yes, but again the “when” part of that is not knowable, and the irony of it is that usually by the time we’re informed that we’re experiencing a recession it’s nearly over.

Would a recession be something unique to our time?

No. While the cause of a recession may be unique from one to the next, our country and economy have faced recessions in the past and after a brief pause have returned to growth.

Will we know what might cause the next recession?

No. The cause of a recession is often not fully understood until months or years after a recession has actually ended and some are debated for decades to follow.

Now we know there will be another recession, but we don’t know when it will be or what will cause it. But we do know that it will end at some point and growth will resume. How’s that for clarity?

Despite providing a lack of clarity, these facts are liberating in the sense that acceptance of them can help focus us on those things that really matter – our goals – and allow us to build a plan and portfolio that reflect those goals in the face of an uncertain future. Whether a recession starts tomorrow, or strong growth continues for a few more years before the next recession, you’ll be able to accomplish your great things despite constant distractions.

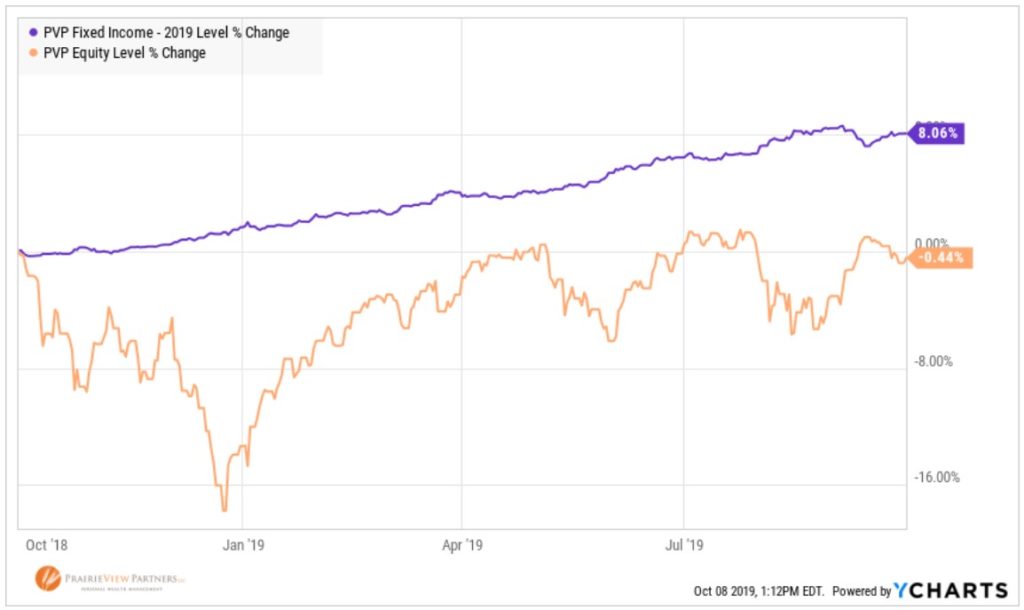

If you’ve been in for a meeting in the last several months, you may have seen the two charts below. As a quick refresher, the purple line represents bonds and the orange line represents stocks. The first chart represents the last twelve months and the second goes back to 2013.

A little over a year ago, stocks were increasing nicely and interest rates seemed destined to only increase from there, or so it was said. Then stock prices turned lower falling 20% or more before beginning their recovery and interest rates started declining again sending bond prices higher in the past year. A portfolio built on predictions of the time may have distracted from a portfolio’s objectives.

For much of the last six years, it has often been said that the recovery from the Great Recession has become over extended, stock returns cannot continue as they have, and “we’re due” for a recession. There certainly hasn’t been a shortage of potential reasons to believe these concerns might be valid, but despite a few “healthy” temporary declines in stock prices along the way, the recovery has continued. Making investment decisions based on the myriad distractions over the past six years would have led a portfolio astray from its goals.

Unfortunately, we can’t know what will happen next in the economy or markets, but over time stocks will reward us for patience and risk-taking while bonds will help us be patient when patience is most needed. The acceptance of those truths frees us from our desire to predict and instead focus on our goals instead of distractions. Whether stock prices go up or down next or regardless of what the next distraction becomes, if your plan and portfolio reflect your goals great things become possible.

Market Recap

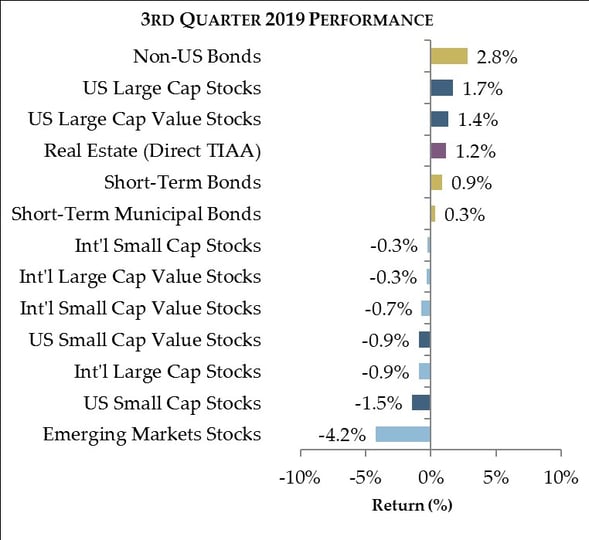

Returns during the third quarter certainly reflect many distractions – concerns regarding US economic growth, more uncertainty regarding Brexit, volatile political dynamics, and global trade led to mixed stock returns. Bond returns reflect further reductions in interest rates in response to those recent concerns.

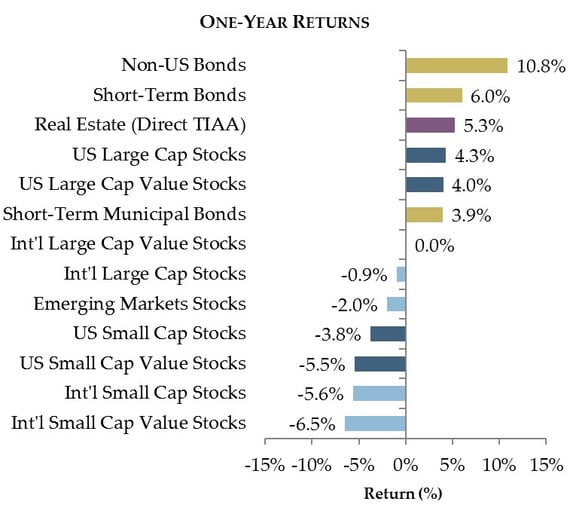

Returns from the last year reflect a similar amount of noise and distractions as well as difficult comparisons to their 2018 highs. One thing to note in the last year’s returns is that of non-US bonds, which are the leading bond category for all time periods summarized here. As interest rates outside the US have fallen, even to negative levels in some cases, the prices of those bonds have increased substantially.

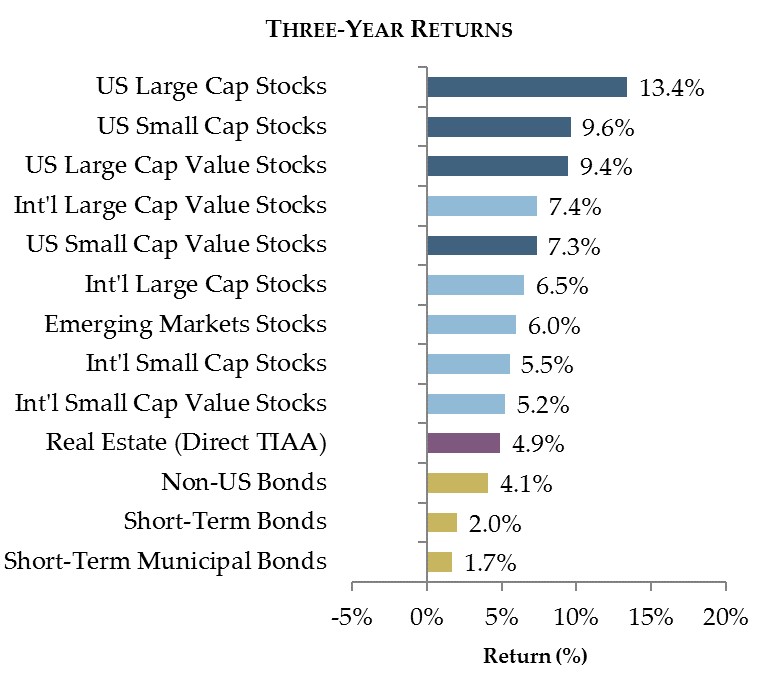

As the return measurement period increases to three years, returns on stocks begin to reflect strong growth in earnings and dividends while bond returns, despite the recent decline in interest rates driving prices higher, reflect a continued low interest rate environment.

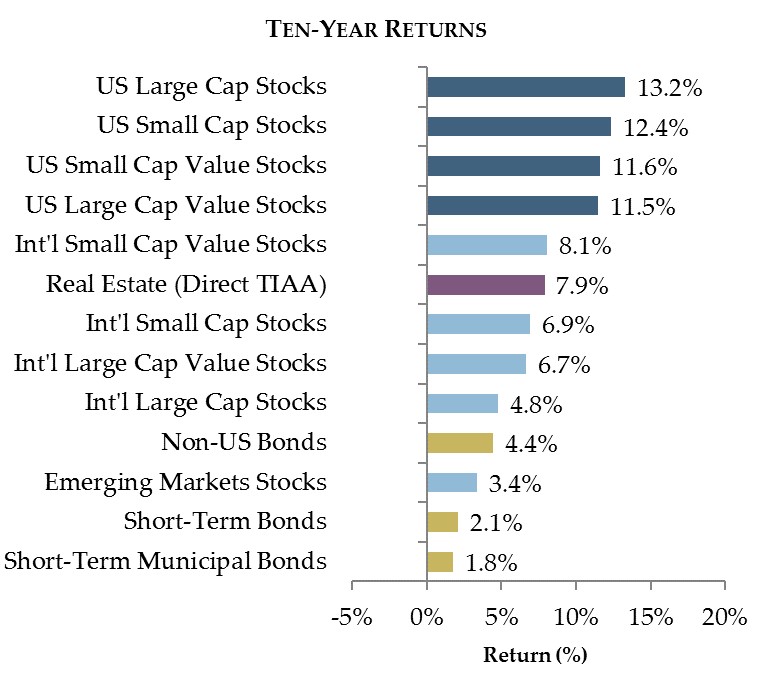

Returns on stocks over the last ten years reflect growth from the post-Great Recession lows, but, like the three-year returns, we see that over time the “cream rises to the top”. This stands in contrast to returns over one quarter or one year that appear to be more random and subject to the distractions of the day.

As a reward to readers who have made it to the end of this piece, I’ll offer a quick preview of what’s to come next quarter when we’ll look at some longer-term comparisons between US and International stock returns. You won’t want to miss it.

Thank you again for allowing us to serve you and please let us know if you have any questions or comments. We always look forward to hearing from you.

Source: YCharts. Indices: S&P 500, Russell 1000 Value, CRSP US Small Cap, CRSP US Small Cap Value, MSCI World Ex USA, MSCI ACWI Value, MSCI ACWI Small Cap Value, MSCI Small Cap World Ex USA, MSCI Emerging Markets, Barclays US Government/Credit 1-5 Year, Barclays Global Agg Ex-US Hedged, Barclays Municipal Bond 1-5 Year, TIAA Real Estate Account. All index returns presented as total return inclusive of dividends.

Matt Weier, CFA, CFP®

Partner

Director of Investments

Chartered Financial Analyst

Certified Financial Planner®