- March 4, 2025

Imagine a world where you don’t wake up in the morning to a plethora of headlines – some positive, the overwhelming majority negative, but collectively confusing and overwhelming – accompanied by stock prices randomly indicating a rise or a decline for the day. Instead, you receive a notification on your smartphone that tells you it’s ok to invest in stocks today. Or, the notification says you might want to wait until tomorrow.

Sounds pretty great, right? For better or for worse, that’s not the world we live in as investors. To be sure, we’re living in a time of generational uncertainty, but uncertainty is, and has always been, a constant presence in financial markets. Investment decisions are always made amidst uncertain conditions. It comes in different forms and sometimes we feel it much more acutely than others, but it’s always there. The “All Clear” notification is never coming.

But that’s ok! We can work with that. I’ll even go as far as to suggest that as long-term investors we’re better off because of it. That’s right – we benefit from uncertainty as long-term investors. This benefit comes in the form of higher long-term returns from stocks than what we can earn on other, more certain, investments, such as bonds.

It’s never been “All Clear”

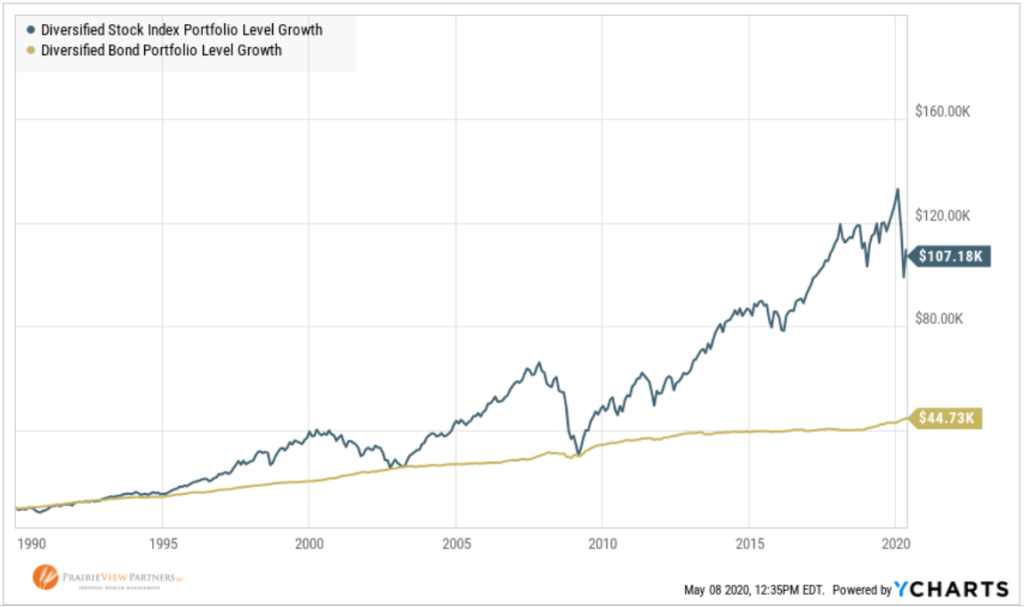

The chart below shows the difference in growth between a diversified portfolio of stocks1 and one of high-quality bonds2 going back to 1990. I chose 1990 because it’s approximately 30 years – a number of years one may expect to accumulate wealth for retirement and also a number of years one might expect to draw upon wealth in retirement. It shows that over those 30 years, the wealth created from stocks was nearly 2.5 times that created from bonds.

At no point during the last 30 years was uncertainty about the future absent. We’ve encountered wars, recessions, a near-collapse of the global economy, once-dominant currencies on the global stage replaced by new ones, two 50% declines in the S&P 500, and now a global pandemic. In that fictional world with smartphone notifications telling us to either invest or wait, the overwhelming majority of days would have seen a notification urging us to wait.

Investing for the long-term in the face of uncertainty has consistently provided owners of diversified stock portfolios with returns in excess of inflation and bonds. Despite countless temporary setbacks and the absence of the elusive “All Clear” notification, stocks have always returned to their path of growth.

Uncertainty creates returns – if you can wait

Without uncertainty, potential returns from stocks would be no better than bonds or cash. And we know we can’t fund a 30-year retirement with the earnings on bonds or cash. Still, some of us right now might be wondering, “where is my return?”, or “when will I see my reward for this risk?”.

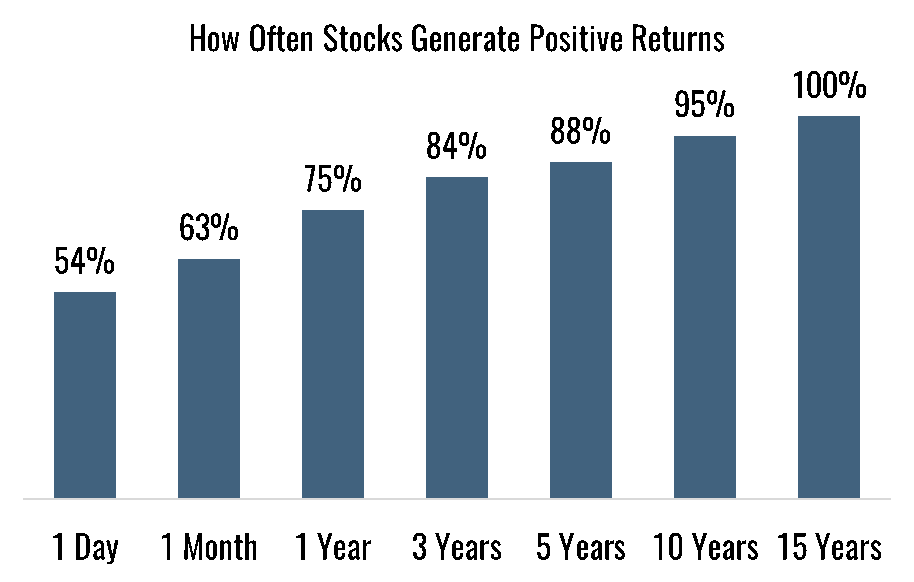

Sometimes returns come sooner and more often than at other times, but there are times when we need to wait a little longer. The chart below shows how often over various rolling time periods we can expect to experience positive returns from stocks.

Any given day is basically a toss-up, but there is a consistent trend that the longer our time horizon the greater likelihood of achieving positive returns from stocks.

And those returns are worth the wait! All the way back to 1926, average annual returns from stocks3, whether we look at 1, 3, 5, 10, or 15-year periods, have been greater than 9.5%.

That said, blindly waiting for stocks to provide us with those returns without a plan for the downturns is not going to be a winning strategy. The absence of a plan makes it much harder to wait for the returns to materialize. This is when we might be hoping for that “All Clear” notification.

Instead, a plan that includes a specified amount in bonds to complement stocks in your investment portfolio and cash in the bank to provide stability and liquidity in the midst of declining stock prices creates the foundation upon which we can wait for the returns from stocks. So, instead of waiting for that “All Clear” notification that never comes, your smartphone would tell you every day “It’s going to be OK – you have a plan for this!”.

It’s always and never different

Every bear market in stocks brings a chorus of experts that proclaim that it’s different this time. There is a similar number of experts who will remind us to beware of those saying it’s different. Both make for catchy headlines and soundbites. Neither are necessarily right or wrong, but both are incomplete.

Every bear market feels different – this one certainly does – and is accompanied by a different kind of uncertainty about the future. Also, whatever caused the last bear market never causes the next one. In the stock market, the specific stocks, sectors, or geographic regions that performed best prior to the bear market often give way to a new set of top performers in the ensuing recovery and next wave of growth.

What is never different is that the economy returns to growth when the problem at hand is solved and stock prices begin to recover when things most certainly do not appear to be “All Clear” – the last 45 days or so is Exhibit A of this. What is also never different is that it never gets any easier to outsmart the market by trying to time entry or exit points for stock investments or seek shelter in cash.

A healthy dose of humility

Warren Buffet is famous for saying that temperament is more important than intelligence for successful investing. I would add that humility is a third key attribute. We’ve recently witnessed the humbling force of biology and financial markets aren’t that far behind in their ability to humble us.

Knowing our limitations as investors – inability to predict the future, difficulty in making investment decisions in the face of heightened uncertainty, and our own biology that favors safety over risk – highlight the importance of investing with a plan and a purpose. With that in place, we should never feel like we need to wait for that elusive “All Clear” notification.

Thanks for reading. Stay safe and be well.

1. Diversified Stock Portfolio comprised of S&P 500, Russell 1000 Value, Russell 2000, Russell 2000 Value, and MSCI All Country World Index Ex-USA. All include dividends. Data Source: YCharts.

2. Diversified Bond Portfolio represented by ICE 3 – 7 Year Treasury Bond Index. Data Source: YCharts.

3. Stocks represented by only S&P 500 total return index in this case due to extensive history. Data Source: DFA Returns.

Matt Weier, CFA, CFP®

Partner

Director of Investments

Chartered Financial Analyst

Certified Financial Planner®