- July 8, 2025

The Best Performing Stocks of the Millennium!

By now I’m sure you’ve heard many recaps of the last year and decade and predictions for the new year and decade. Yes, this is another one. Stick with me. It will be worth it. But, rest assured, as always, this is a prediction-free zone.

A little different than expected but in a good way

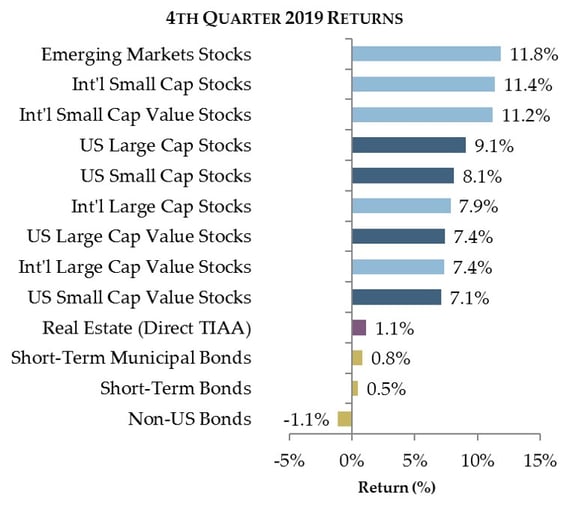

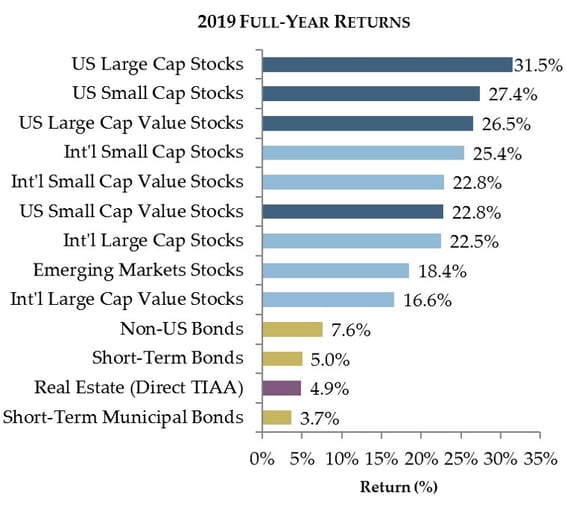

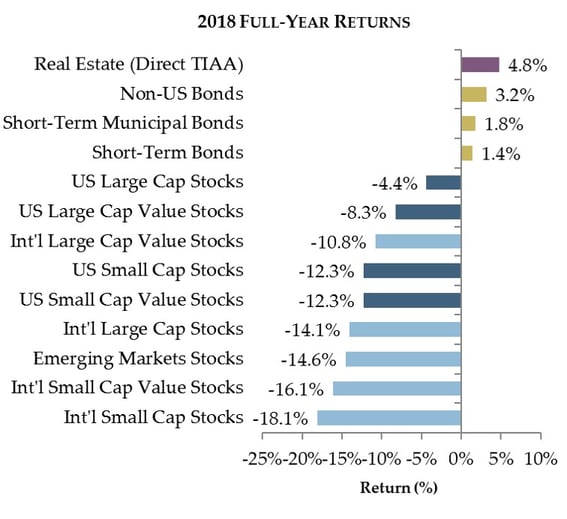

Raise your hand if at the end of 2018, with stocks down 20% or more, you expected 2019 returns of more than 20% on most categories of stocks. My hand isn’t raised. Now raise your hand if you weren’t at least a little concerned about the prospects of a recession in 2019. It’s ok if you didn’t raise your hand.

In 2018 nearly every investment category we track delivered lackluster performance. In 2019 nearly every investment category delivered outstanding performance and the widely expected recession was avoided for the time being.

While it is rare for investment categories to move in the same direction at a given time as we saw the last two years, it is common for one time period to look starkly different from the previous one, as 2018 and 2019 showed us. It’s also common for widely held expectations to be replaced by the unexpected. Everyone knew interest rates were going to keep going up after 2018, right?

Different but the same

Many recaps of the first two decades of the millennium in financial markets have focused on their notable differences. They highlight how the first decade was characterized by two recessions and massive stock market crashes while the second was characterized by the absence of a single recession – the first decade since the 1850s without one – and stock prices that went more or less straight up save for a couple “bear-cub” markets where stocks declined only about 20%.

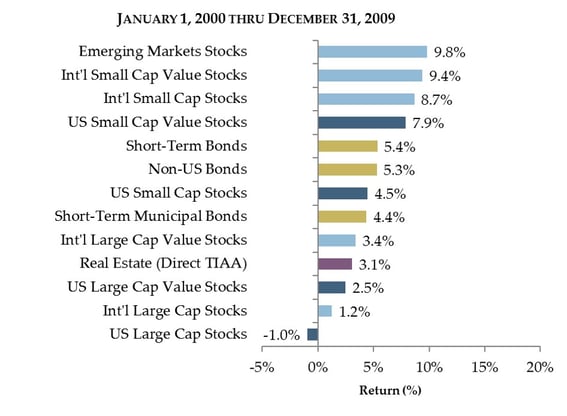

The first decade of the millennium saw Value Stocks, Small Cap Stocks and International Stocks, especially of the Emerging Markets flavor, trounce the growth stocks that were the stars of the 1990’s. Do we even remember the ‘90’s anymore?

The recently ended decade was all about US Growth Stocks, particularly Facebook, Apple, Amazon, Netflix, and Google. They even earned a catchy acronym – FAANG Stocks. The stars of the previous decade, Emerging Markets, also earned an acronym – BRICS, for Brazil, Russia, India, China, and South Korea.

It wasn’t only markets that were vastly different in the two decades. Remember that Blackberry you may have had 15 years ago? Has anyone seen one of those recently? We used to wait for our Netflix DVDs in the mail. Could you imagine waiting that long to watch last year’s Game of Thrones final episode? In 2003 the world was fearful of the SARS virus – in 2014 it was Ebola. In the early 2000’s (2000 – 2009), Hummers roamed the streets guzzling gas and striking fear that the world was running out of oil. In recent years, Teslas and other electric vehicles have become more prevalent and global oil consumption has declined. Just this week GM announced the rebirth of the Hummer – as an electric vehicle.

Those reviews focus on the details, though, which are full of randomness. If we step back farther to view the whole forest instead of focusing on the trees, the first two decades of the millennium were exactly the same in three important ways:

- Expectations at the start of each decade didn’t always happen

- Events that actually happened were not widely expected to happen

- Lessons from one decade made lives better in the following decade

We were sure that was going to happen

When the calendar was getting ready to flip to the year 2000, tech stocks were still booming and the expectation was that the sky was the limit for US tech stocks. “Why would anyone invest in anything else?”, was the question often rhetorically asked. I think most of us remember how that party ended.

The beginning of the last decade was marked by a time of historic uncertainty. Fear in financial markets and talk of a “double-dip recession” ruled the day and the expectation of continued low stock prices was prevalent. These expectations sent investors clamoring into bonds and other investments to shield them from the volatility or risk of stocks. Before we knew it, stocks recovered their pre-crisis highs. A few years later they were double what they were before the crisis.

Shortly before the financial crisis began, near the end of the previous decade, the prevailing expectation was that the US economy’s, and therefore its stock market’s, best days were behind it and Emerging Markets were going to rule the 21st Century. There was even an expectation that the Euro was going to replace the Dollar as the dominant global currency. Emerging market stocks have lagged US stocks since that prediction was made and the Euro has fought for survival.

As we entered the 2010’s (2010 – 2019) in the midst zero interest rates and historic monetary stimulus the expectation was for the return of heightened inflation and rising interest rates. Ten years later we still have low interest rates and barely existent inflation – except in healthcare and higher education.

Didn’t see that one coming

Perhaps the biggest unexpected occurrences of the last decade were the seemingly uninterrupted march higher of nearly all stock markets and consistent economic growth. These are both surprises that certainly fall into the good surprise category. But, while it seems so obvious now with the benefit of hindsight that these outcomes would be the case, it was far from certain with the global economy on shaky ground as we entered the 2010’s.

It seems easy now to say, “sure, US Large Cap stocks should have experienced strong gains – they were coming off what was called their ‘Lost Decade’ after finishing the 2000 through 2009 period with a total return of negative 9%”. That was far from the prevailing expectation at the end of that decade when Emerging Markets stocks gained over 200%.

Also, with the economy on such uncertain ground entering the last decade, the prevailing expectation was always that the next recession was right around the corner. The absence of a recession during the decade was an unexpected and welcome outcome but shows us that as investors we need to be prepared for the unexpected whether good or troubling.

The world is a better place despite the headlines

Last month, the World Health Organization announced that a cure for Ebola is in final stages. This week, the Wall Street Journal reported that China’s experience with SARS greatly improved their ability to contain the spread of subsequent pandemics. Global poverty continues to fall as more residents of countries classified as Emerging Markets enter the middle class through education, technology, and improving economic mobility. Maybe these trends bode well for the future of Emerging Markets’ economies and financial markets.

The surprise winners

A year or a decade are nice, neat milestones for recapping investment returns. The fact remains, though, that as investors, we will be investing for many years and several decades. The recent two decades provided examples of why it is important to keep this in mind.

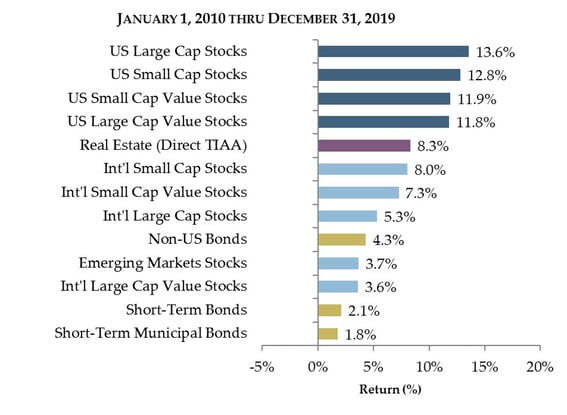

It’s no surprise that International Stocks have lagged US Stocks, such as the S & P 500, for the last decade. Many of us may remember that the previous decade saw the exact opposite. Fewer of us may realize that US Value Stocks and US Small Cap Stocks have also lagged the S & P 500 in the same time.

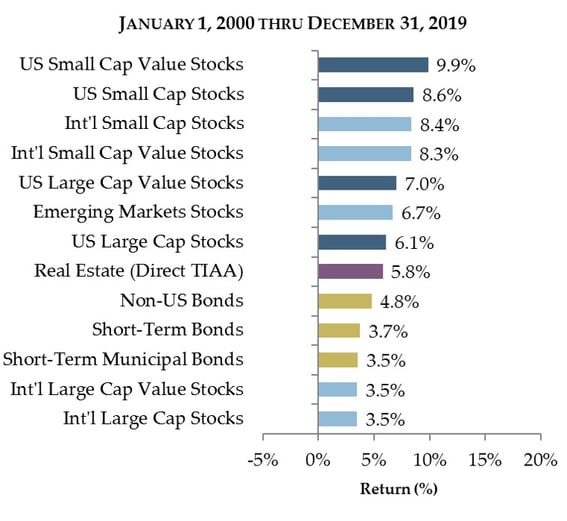

With the knockout performance delivered by the S & P 500 in the last decade – up nearly 14% per year compared to 13% for US Value and 12% for US Small and only 4% for Emerging Markets – it might seem like a foregone conclusion that it has now surpassed all other categories in the millennium to date. That is not the case.

The top six best-performing stock categories of the millennium so far are as follows:

- US Small Cap Value: 9.9% per year

- US Small Cap: 8.6% per year

- International Small Cap Value: 8.3% per year

- US Large Cap Value: 7.0% per year

- Emerging Markets: 6.7% per year

- S & P 500: 6.1% per year

Anyone else surprised? Despite the fact that I’ve been known to mention every now and then that Small Cap Stocks and Value Stocks tend to outperform and that global diversification pays off over long periods, I’ll admit that I was a little surprised when I first put that list together. I thought the S & P 500 would be in the top 5, but I guess I’m not immune to a little recency bias myself.

Another interesting observation is that every one of those categories, at some point during the last 20 years, has been considered best to be avoided, its best days were behind it, overvalued, undervalued, and the best place to invest for the next year. It should also be noted that the top five on that list were among the most maligned categories twenty year ago.

Still no predictions

The saying goes that Generals always fight the last war and economists fight the last crisis. Maybe this is because of an implicit understanding that the next event can’t be predicted and there is some sense of safety in believing the next will be like the last. If the last two decades in financial markets have taught us anything it is that expected outcomes won’t always happen, unexpected events will happen, risk will continue to be rewarded, and if we plan with those facts in mind we won’t need to predict.

Cheers to a new year, a new decade, and a diversified portfolio.

Thanks for reading!

Matt Weier, CFA, CFP®

Partner

Director of Investments

Chartered Financial Analyst

Certified Financial Planner®