- July 8, 2025

With the recent downturn in the markets, you may have heard us mention the phrase “Tax Loss Harvesting”. Before I dive into the myriad benefits of tax loss harvesting, I think it’s important to mention the basics of how gains and losses are treated so that we’re all on the same page of the IRS tax code.

Just as the IRS requires you to pay taxes on capital gains when you sell stocks or other investments, they allow you to deduct capital losses from your ordinary income when you sell investments at a loss. It also allows you to net losses against gains on other investments. Note: this only applies to your “taxable” brokerage accounts – IRAs, 401ks and other tax-deferred accounts are not eligible for this.

To start an example, let’s say that your Vanguard Total Stock Market Fund declined 20% resulting in a $10,000 loss. If you sold this fund, you’d realize or “harvest” the $10,000 loss. There are two beneficial uses of this loss that effectively turns your “harvested” loss into an asset:

- Offset capital gains realized that year

- Offset your other income sources

If you sold stocks earlier in the year to pay for a new car or a house remodel, and you realized $10,000 in capital gains in the process, you can net those gains against your loss and end up with $0 in realized capital gains for the year.

If you don’t have any capital gains to offset during the year, or if your capital losses harvested exceed your capital gains, you can deduct up to $3,000 in losses from your other income. Any unused losses can be carried forward to following years, which allow you to potentially benefit from harvested losses even beyond the year they are realized.

Harvest the Loss. Keep the Investment.

Now, selling out of stock funds after a 20% decline isn’t a great idea, so we need to replace the investment in a way that maintains your portfolio’s investment targets.

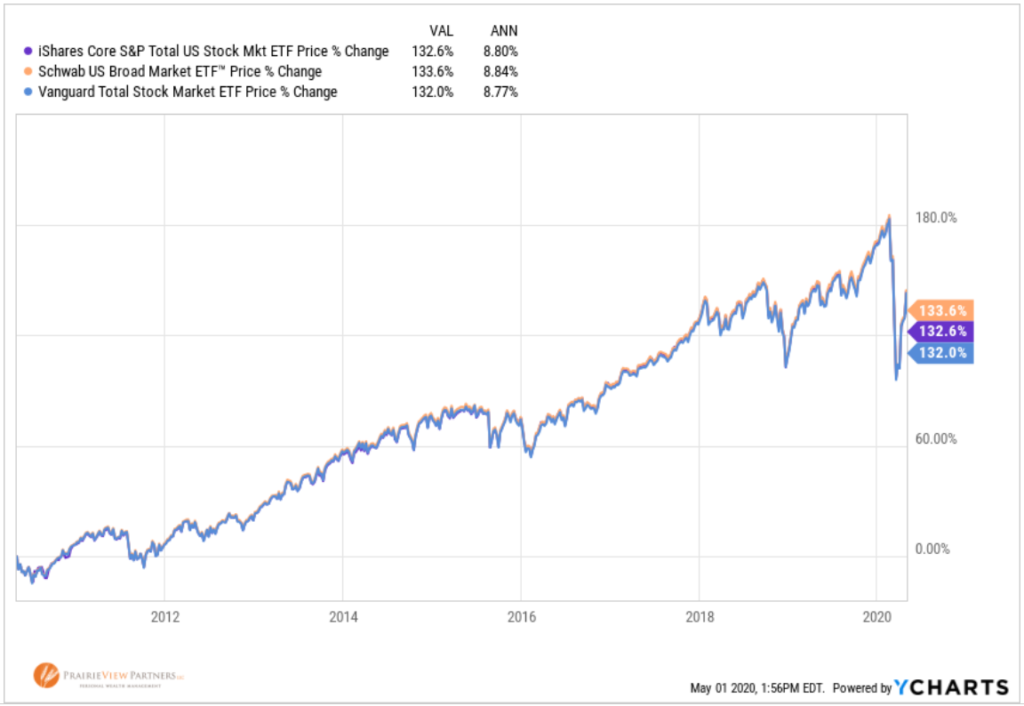

This strategy works particularly well with index ETFs due to the fact that the funds in any given category all track similar stock indices. You end up with a different fund, but effectively remain invested in the same underlying investments while having realized the investment loss for tax purposes.

To close the loop on our example, after selling the Vanguard Total Stock Market Fund to realize the $10,000 loss, we can use the sale proceeds to buy a Schwab or iShares Total Stock Market fund. The result is that your portfolio remains similarly invested, but you can potentially save $2,200 in taxes on that original $10,00 capital gain (15% Federal capital gains tax plus 7% MN income tax rate times $10,000 = $2,200 tax savings; your actual tax rates may vary from example).

If you’re a stock picker, this strategy isn’t quite as seamless. If you were to sell shares in 3M stock, for example, you must remain out of those shares for 30 days otherwise the loss is disallowed. This constraint on single-company stocks for this strategy does run the risk of altering an investment strategy.

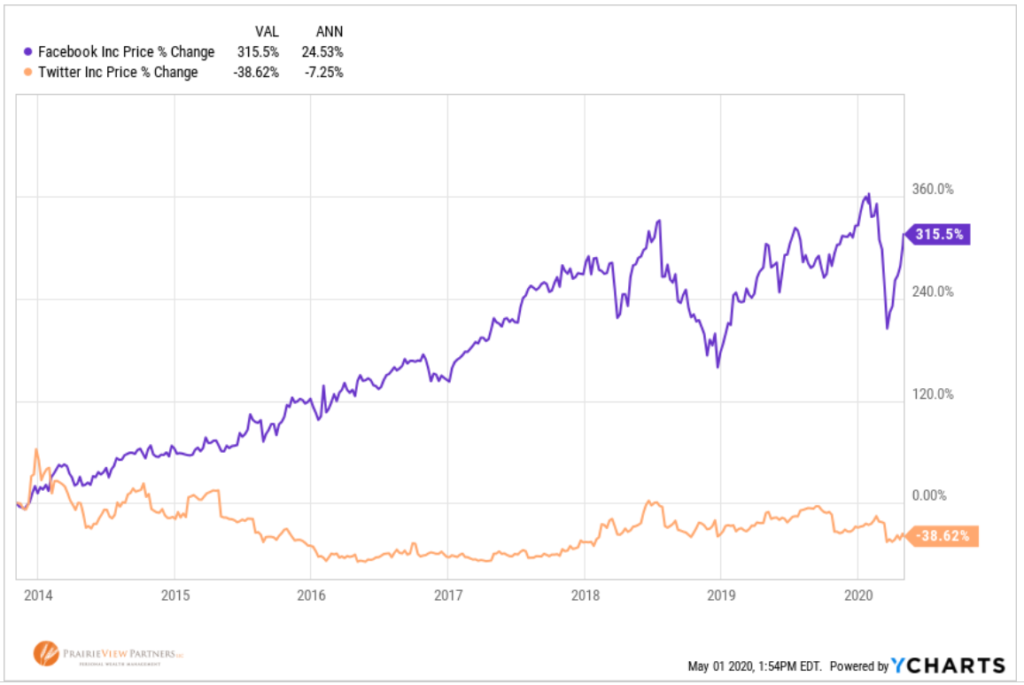

While 3M and GE or Honeywell might be in the same industry or sector they may experience very different business environments as one may be struggling more than the others when it comes time to tax loss harvest. To give another example, if you harvested a loss in Twitter stock, reinvesting proceeds in Facebook stock might not provide the same investment result due to company-specific factors. Therefore, Tax Loss Harvesting is best implemented with diversified ETF investments or to transition from single stocks to diversified ETFs.

Improve Your Portfolio

Another benefit of tax loss harvesting is it can help diversify a highly appreciated or concentrated position. Let’s say you’ve held Apple for the last 30 years, and it’s become an outsized position when compared with your overall portfolio allocation. You’d like to sell, or maybe more aptly your financial advisor would like you to diversify a portion of it, but the capital gain that will be incurred often makes diversifying costly. Matching losses incurred during the year through tax loss harvesting with the gains incurred on the sale of Apple, can help gradually slim down your outsize position without getting hit a with a big tax bill.

Reduce taxes on next year’s withdrawals

As was mentioned earlier, if you don’t have any capital gains to offset during the year, or if your capital losses harvested exceed your capital gains, you can use up to $3,000 in losses to offset your other income. Any amount of losses that is over and above $3,000, is permitted to be carried forward to the following tax year and applied to future income.

For those of you who rely on taxable accounts to meet your monthly withdrawals, you probably know that by the time the end of the year rolls around, the amount of realized capital gains starts to add up. Having $3,000 of carry forward losses to help offset these gains each year can be a big help when it comes time to pay taxes. Stocks often experience temporary declines every 2-3 years that allow for tax loss harvesting that can reduce the impact of capital gains.

Making lemonade

While nobody roots for a downturn in the market, taking advantage of these temporary declines can create great opportunities to offset some capital gains incurred for a specific goal or help rebalance a portfolio without owing a big tax bill.

Thanks for reading and be well.

Matt Weier, CFA, CFP®

Partner

Director of Investments

Chartered Financial Analyst

Certified Financial Planner®