- November 20, 2024

Everyone loves saving taxes. And with the stock market’s downturn, Roth conversions are gaining more attention as a way to do just that. What exactly is a Roth conversion? When do they typically make sense? As with most financial topics, the answer is, “it depends.”

How it Works

To implement a Roth IRA conversion, an IRA owner transfers all or a portion of their traditional IRA to a Roth IRA. The amount transferred is included in the IRA owner’s taxable income. When qualified Roth IRA distributions occur, the distribution will be tax free to the IRA owner and future beneficiaries.

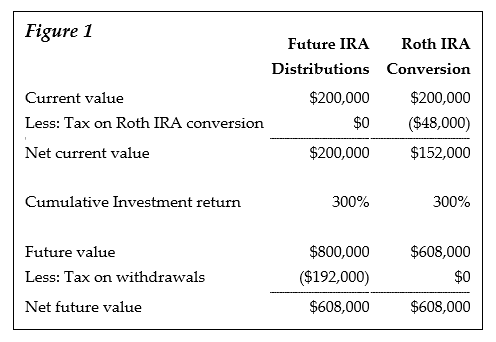

To illustrate, let’s assume that $200,000 is converted from an IRA to a Roth. If the IRA owner is in a 24% marginal tax bracket, ordinary income taxes ($48,000) are due at conversion. But, from that point forward the Roth IRA grows tax free. Often, the upfront tax bill creates a sufficient obstacle for many taxpayers; execution of the strategy becomes difficult. Let’s further assume, however, that the IRA owner has an after-tax brokerage or bank account with sufficient resources to pay the tax bill. In this circumstance, how do the numbers behind the conversion turn out?

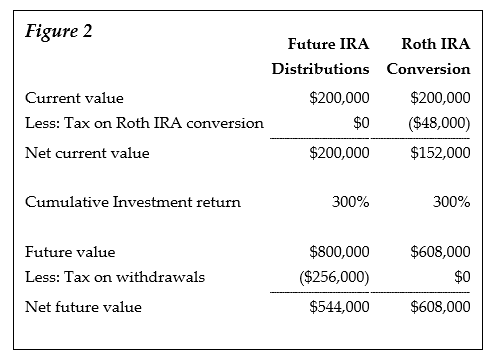

If the two values are equal, then why is it a viable strategy? One reason: the taxpayer expects their future tax rate to be higher than their current tax rate. In the above example, assume the taxpayer’s marginal rate jumps to 32% in later retirement years. The numbers look quite different:

The reverse is also true. If the taxpayer expects their future tax rate to be lower than their current tax rate, the net future value would be lower by making a Roth conversion today. In this instance, the Roth conversion would not be a viable strategy.

Opportunities Abound

In 2020, required minimum distributions are suspended. Thus, opportunities may exist to implement a Roth conversion either in place of the income the RMDs would have generated or to maximize one’s existing tax bracket.

It may also be possible to convert a portion of an IRA over a series of years – possibly at retirement while Social Security or pension income is delayed.

Rules to Keep in Mind

Once the conversion occurs, there are rules to keep in mind. The conversion is no longer reversible because recharacterizations are no longer allowed. Therefore, once you convert, it is irrevocable.

Also, two five-year rules should not be forgotten. The first five-year rule determines whether the earnings will be interest free; the second five-year rule determines whether the conversion principal will be penalty free.

Meaning, you cannot withdraw your converted assets from the Roth IRA for 5 years after the conversion, otherwise penalties and taxes may apply. So, if your Roth is “untouchable” for five years and the $48,000 in the example was paid in taxes, cash flow reasons may make this strategy problematic.

Beneficiaries Matter

The taxpayer’s ultimate plan to pass on the account is another factor to consider. If the IRA eventually passes to beneficiaries, their tax bracket must not be overlooked.

Let’s say wealthy mom converts an IRA, pays the taxes due, and then passes the Roth IRA to her not-so-wealthy son. The mother will pay more taxes because of the conversion than the son would if he inherited the Traditional IRA.

Another consideration: after passage of the SECURE Act, the benefits of a stretch IRA are no longer available. Previously, an IRA beneficiary (Traditional or Roth) was required to take distributions over his or her life expectancy. Today, that distribution period is 10 years.

Roth IRAs, in contrast, are not subject to the required minimum distribution rules while maintained with the original owner and spouse.

Consider Market Activity

Finally, what does the recent stock market downturn mean for conversions? For accounts invested in equities, the IRA balance is probably less than it was a few weeks ago. The $200,000 conversion above might have been $250,000 to $260,000 at the beginning of the year, which means less tax will be due when converting the same number of shares within the account.

There are no clear-cut answers when deciding whether to execute a Roth conversion. The factors can be complex and difficult assumptions must be made. Whether a conversion makes sense must be evaluated on a truly personal and specific level; yet, even then the answer may still be … maybe.

Kristy Schaffer, CPA/PFS, CFP®

Partner

Certified Public Accountant

Certified Financial Planner®

Personal Finance Specialist