- April 8, 2025

A lot has happened so far in 2020. You can say that for every year, but 2020 took it to a new level with the COVID-19 pandemic and associated upheavals to our lives and financial markets. Add to that a Presidential election that took five days to count, it’s understandable why any investor might have a higher level of concern about the direction of markets.

A few quick disclosures before continuing:

- In no uncertain terms is anything that follows intended to be political commentary

- There will be a modest amount of wonky financial figures

- As always, this is a prediction-free zone

Why were stocks higher without a final vote result?

A headline in the Wall Street Journal at the end of the day on Thursday November 5th indicated that stocks were on their way to their best week since April. This came only a few days after the week prior ended with a headline that indicated stocks had their worst month since March. This seems a little disingenuous since the S&P 500 fell 3% in October and 12% in March.

But the bigger question here is how can it be that at the end of election week, when we still didn’t know the final results could stocks have risen so much. Don’t stocks decline when things are uncertain? Sometimes. Let’s see where things stand right now:

At the time of this writing the Democratic candidate was declared the President-elect, the Republican Party is expected to maintain control of the Senate and the Democratic Party is expected to maintain control of the House of Representatives. This would indicate:

- Previous concerns about a “blue wave” that would be unfriendly to business may be less likely to fully pan out

- Tax rates may rise, but possibly not to the degree feared in the “blue wave” outcome

- We may be more likely to get a COVID-related fiscal stimulus bill, which could be more broad-based than had the incumbent won but not quite as large as in a “blue wave” outcome. This balance may be viewed as a near-term positive for economic growth with less long-term inflationary concern resulting from lower amounts borrowed.

- There may be anti-trust cases brought against the big-tech companies, but possibly not as severe as in a “blue wave”

As I wrote about when markets began to recover following the depths of the spring selloff, markets prefer a narrower potential range of outcomes to a wider range of potential outcomes. Back then, as the worst-case predictions of the pandemic became less likely, stocks began to recover. Now, the potential range of outcomes that could develop from different political outcomes has narrowed.

Translating narrowing potential outcomes to stock prices

Part of this result on markets is driven by sentiment or confidence in the future outlook and part of it is driven by math. Stock values are derived from their future earnings discounted to the present. If there is a higher degree of confidence in future earnings, those earnings are discounted at a lower rate and produce higher stock prices.

Consider a simple example of a stock that was expected to earn $5 per share every year. If you didn’t have a high degree of confidence in the company’s ability to execute on that due to the business climate, you might discount those earnings at 12%. However, if the company’s business climate was a little more certain you might discount those earnings at 8%. Let’s see how this works:

- “Less certain” business environment: $5 / 12% = a stock price of $41.67

- “More Certain” business environment: $5 / 8% = a stock price of $62.50

Applied to actual stock markets, the interpretation of the election outcomes favored by current vote tabulations indicates that markets view a divided government as favorable and, therefore, apply a lower discount rate to future earnings to produce higher current values.

Underneath all the noise, at the most elementary level, it really is that simple.

A note on change

All that said, any time there is a change in leadership a recalibrating of expectations does tend to take place. This recalibrating can cause stock prices to jump quickly higher – possibly characterized by more confidence and a temporarily lower discount rate. Or, they can decline temporarily due to a potential new risk to future earnings – investors possibly applying a higher discount rate to future earnings.

This recalibrating is effectively what you may hear referred to as “heighted volatility” and may cause financial media to indicate that it is giving investors the dreaded “jitters”. Of course it is rarely mentioned that volatility is measured by the statistical term, standard deviation, which is symmetrical and also refers to stocks being volatile in an upward direction.

No one complains about the upside of volatility, but the term “volatility” always conjures up a negative connotation. But the reality is that you can’t have one direction of volatility without the other.

The above example of future earnings being discounted at 12% or 8% is a rather large difference. In reality, the daily shifts in confidence and sentiment, corporate developments, interest rates, inflation, etc. have the market trying to determine not if the discount rate should be 12% or 8%, but rather 7.95% or 8.05%.

- $5 / 8.05% = $62.11

- $5 / 7.95% = $62.89

- That is a 1.25% difference, which may result in a headline such as “Stock Prices Plunge on Investor Jitters of Heightened Volatility”.

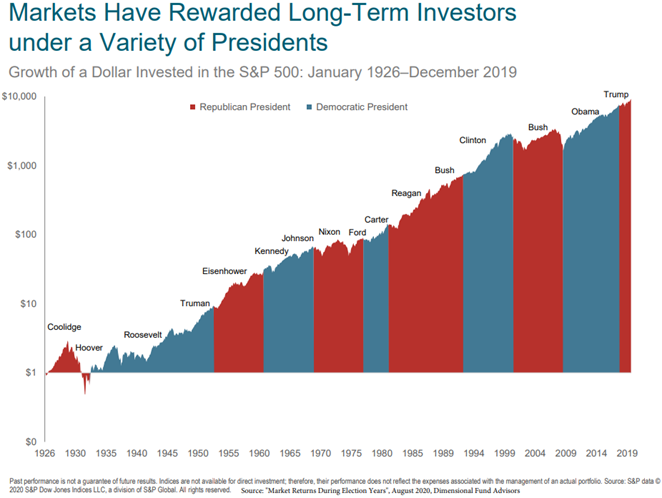

It’s important to avoid extrapolating any stock returns during the recalibrating period to expectations of what a certain administration may bring to markets – particularly if the recalibrating period results in a decline in stock prices. As a reminder that markets tend to adjust expectations and rise regardless of the administration at the helm, I’ll recycle this chart that was included in last month’s post.

What it means for your portfolio

The image above should provide some evidence that, pending a possible recalibrating period of “heighted volatility” where investors may come down with a case of the “jitters”, stock returns are more likely than not to be favorable throughout an administration’s term. This is good news for your portfolio and financial success whatever your political beliefs may be. Provided you remain invested in stocks for the duration.

It’s for this reason that we should not let our politics influence our investment decisions. Two examples provide some evidence for this recommendation:

- The first three months of Ronald Reagan’s presidency, often viewed as one of the most business-friendly administrations, produced the worst stock returns of the last 10 administrations’ same first three months.

- At the beginning of our current incumbent’s administration, the view was that it would be friendly to oil and related sectors. That ended up being the weakest performing sector during the administration – even before the price of oil was briefly negative early in the pandemic.

As is normally the case, we’ll follow the data when it comes to making important investment decisions:

- There is no statistical difference in historic stock returns based on political party representing any branch of government.

- Markets often do experience “heightened volatility” around any time of change in expected outcome, but its important to remember that volatility can also be in an upward direction.

- Predictions of sector winners and laggards based on shifting political winds have a low batting average.

Conclusion

This all means that regardless of shifting political winds, the best investment outcomes are still determined by the investment factors we can control. The appropriate amount of risk in our portfolios should be determined by our needs rather than current events or news headlines. And diversification beats prediction.

Matt Weier, CFA, CFP®

Partner

Director of Investments

Chartered Financial Analyst

Certified Financial Planner®