- July 8, 2025

I hope everyone is having an enjoyable summer so far. I’ll do my best to keep it that way by making this update brief so you can return to your summer pastimes.

I’ll admit that, at least when it comes to markets and the economy, this summer has been a little more pleasant than last summer. At the end of the second quarter of 2022, the S&P 500 was more than 20% off its peak level set on January 3, 2022. Today, it is within 5% of that all-time high, including dividends. Add to that the facts that the inflation reading in June 2022 was over 9% while last month’s reading was 3%. Overall, today’s picture is quite different than a year ago.

When stocks were down 20% last June, the expectations centered on how much more they were going to drop and how long they would remain down. When inflation was increasing at the fastest clip in decades, the expectation was that we were in for a repeat of the 1970s, when inflation exceeded 10% for several years.

Despite quite different economic environments now versus a year ago, one prevailing expectation remains. Pundits continue to say we’re in for a recession in six months. I suppose that if one were to continuously call for a recession six months into the future, one would surely have a right call eventually. However, that wouldn’t produce a career batting average worth bragging about.

But what if we had the ability to perfectly predict a recession? Would it be possible to avoid the expected market decline associated with a recession? Nir Kaissar of Bloomberg did an interesting study of the last 30 recessions going back to 1871 and summarized them with three perfect market timing scenarios:

- If one could perfectly exit stocks on the eve of a recession and re-enter stocks at the conclusion, losses could have been avoided in 18 out of the 30 scenarios. But that assumes perfect timing. Good luck.

- If one were to see a recession coming in six months (sound familiar?) and exit stocks six months before the onset of the recession and re-enter stocks at the end of the recession, losses were only avoided in 15 out of the 30 scenarios. A coin flip’s odds aren’t exactly a winning investment strategy when dependent upon perfect exit and entry timing.

- Lastly, again assume one could see the recession coming in six months and exits stocks six months before the onset. Additionally, one assumes that once the recession is announced stocks are often already recovering, so re-enters stocks upon the announcement of the recession. In this case losses were only avoided in 9 out of the 30 scenarios.

I’ve touched on the perils of market timing in these notes in the past, but this study points out perhaps an even more fundamental observation of how markets work. Expectations don’t always equal outcomes in the short-term.

It seems obvious to expect stock declines during a period of weakening economic output; however, the data doesn’t support this expectation. So, for better or worse, we’re left with the best alternative - maintaining our investment plan regardless of short-term market expectations.

The allure of what’s working now

Closely related to the notion that expectations don’t always equal outcomes is what I’ll call the “allure of what’s working now.” This often complements what behavioral economists call recency bias, the tendency to place a higher emphasis on what has occurred most recently and extrapolate that into the near future.

At the end of 2022 and early 2023 stocks were still down 20% or more. Money market funds, CDs and short-term Treasury bills’ interest rates were approaching 5% for the first time in nearly 15 years. It’s common and understandable to think that stocks will do what they have done most recently and continue to fall. The alluring 5% yield on cash equivalents, “what’s working now,” became rather attractive, leading many investors to replace their stocks with money market funds.

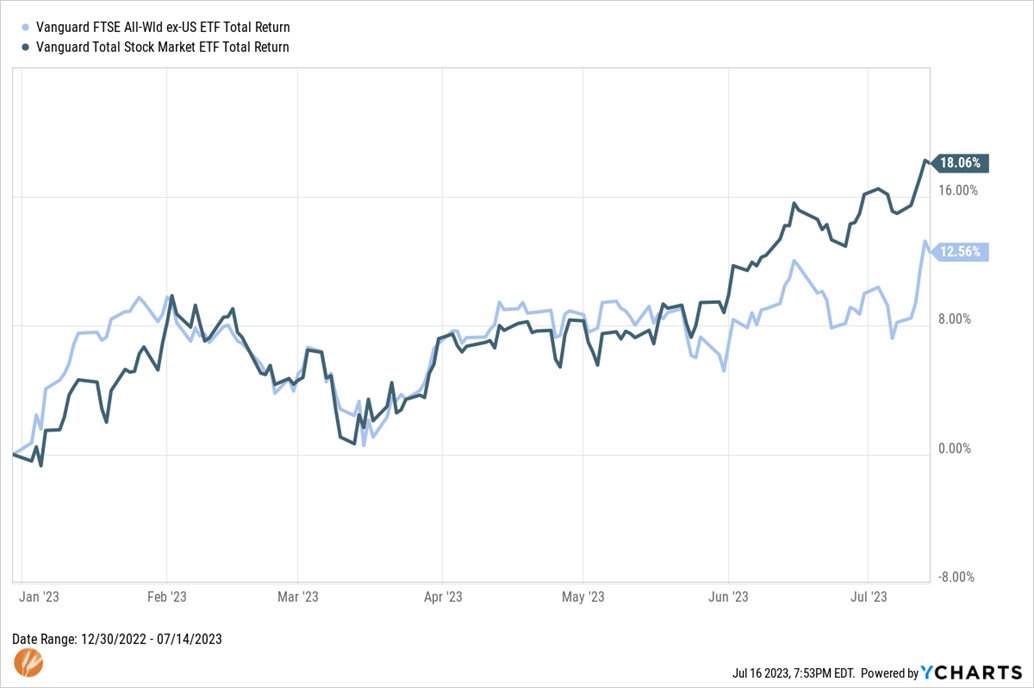

To be sure, 5% on funds that would otherwise be in cash anyway is most definitely a win! But, as a replacement for stocks, it falls short. As investors began to pile into money market funds, outcomes once again defied short-term expectations. Since the bear market low on October 13th, 2022, US stocks are up 23% and International Stocks are up 27%. Since the start of 2023, they are up 18% and 12%, respectively.

As is normal during bear markets and unsettled economic environments, conditions were often described as uncertain in 2022, which supported the allure of “what’s working now.” This is what I’ll refer to as the Uncertainty Fallacy – times of higher perceived risks in markets and the economy are described as uncertain. However, the fact remains that the future is always uncertain, but there are times when investors are better at ignoring that fact (see market conditions in 2021) and other times when its all-consuming (see market conditions in 2022).

Set expectations over the long term

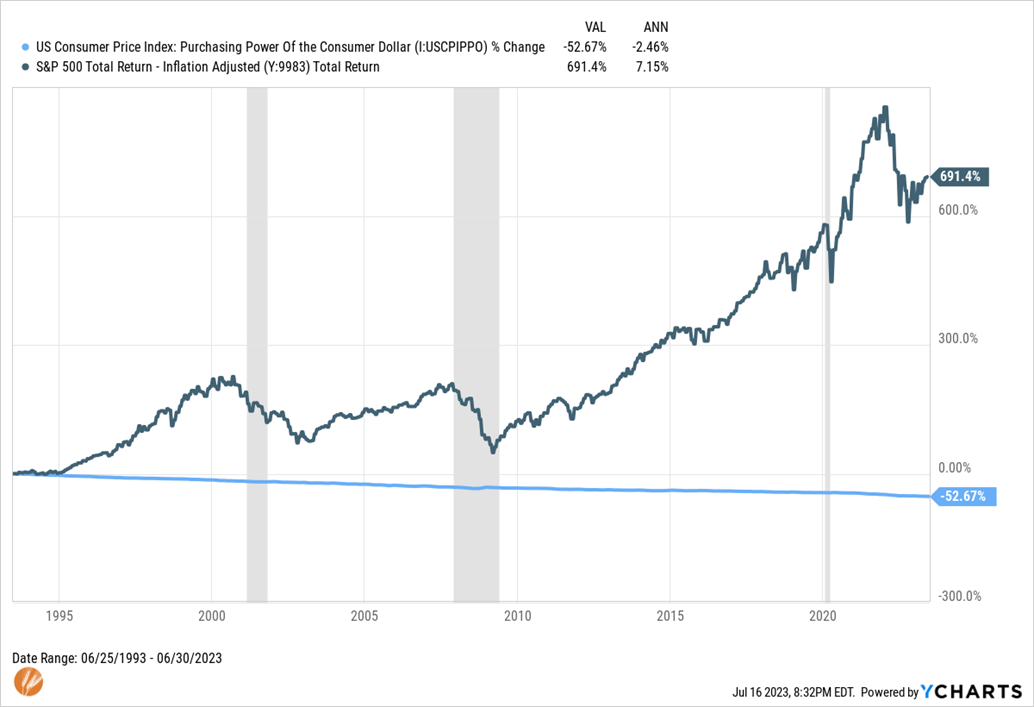

To return to the topic of expectations and outcomes, if we set our expectations broad enough, base them on historical market evidence, and evaluate the outcomes over a reasonably long time period, we can generally expect outcomes to align with expectations.

To apply this to our examples of stock returns, inflation and recessions, expectations might go something like this: Over a reasonably long time period, a diversified portfolio of stocks should be expected to return positive real (above inflation) returns and inflation will gradually erode the purchasing power of cash despite periodic recessions. This aligns with the outcome over the last 30 years.

Having reasonable expectations and a plan that considers the fact that short-term markets will often deviate from the long-term expectations can help us avoid trying to outsmart markets. Relying on intuition or short-term expectations can be perilous to financial outcomes.

Thanks for reading.

Matt Weier, CFA, CFP®

Partner

Director of Investments

Chartered Financial Analyst

Certified Financial Planner®