- July 8, 2025

January 2020

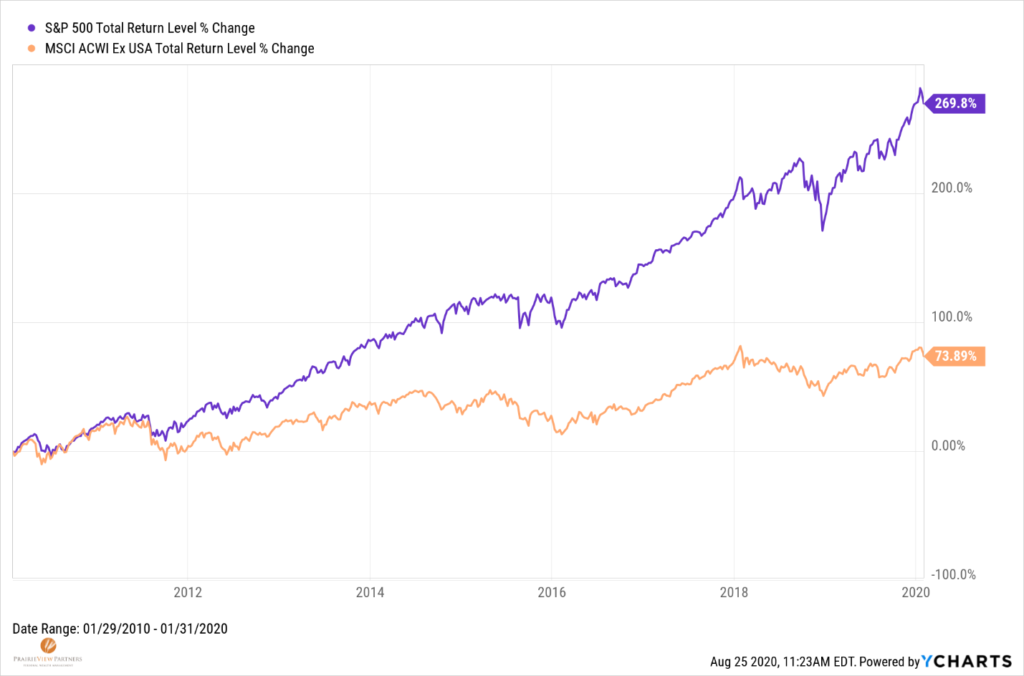

Flash back to January 2020. The U.S. economy was booming. Unemployment stood at 3.6%. The stock market was on a record 10 year run in which the S&P 500 had outperformed its international developed market peer index by 200% (See figure 1.1). And, the U.S. appeared to be mostly winning the trade war with China. Why would anyone want to own International stocks in this kind of environment?

March 2020

Now let’s flash forward from January to March. By then, the Coronavirus had spread around the world, and the global economy had slowed to a standstill as governments tried to slow the spread of the virus and flatten the curve. This strategy resulted in mass layoffs, sending the unemployment rate in the US up to 14.7%, and led to record breaking volatility in the stock market with the major indices moving up and down by 10% or more on any given day.

Then the world’s biggest bank, the Federal Reserve, stepped in and slashed interest rates to zero, pledged massive bond buying for corporations, and provided trillions of dollars’ worth of liquidity to stabilize the US Market. On top of this, Congress signed the CARES Act, authorizing $2 trillion of stimulus to be distributed to individuals and businesses alike. As the world’s reserve currency, the US was able to borrow trillions of dollars from itself to stave off an economic meltdown. Again, why would anyone want to own international stocks in this kind of environment?

Present Day

Finally, let’s jump forward to the present. The United States’ decentralized style of government has led to 50 states with 50 different strategies to control the virus. Some states have succeeded. Some states have failed spectacularly and are now being forced to roll back reopening measures and are setting records for number of new daily cases and deaths.

The stimulus money has now been spent, and it’s highly uncertain what comes next for the economy. In Europe and Asia, stringent and coordinated measures have slowed the number of new cases and deaths to a trickle, sports teams are letting fans back into stadiums, and continental travel and tourism is resuming. The European Union recently came together and passed an $857 Billion Eurozone wide stimulus package, led by France and Germany. At this point, why would anyone want to own U.S. (domestic) stocks in this kind of environment?

Forecasting is impossible

The point of the anecdotes above is to reinforce the idea that it’s nearly impossible to forecast or predict how the economy will perform in the upcoming 6-12 months, much less the next 6-12 years. It’s also impossible to predict whether the US or international markets will outperform.

This exercise becomes effectively impossible when you add in an unprecedented global pandemic that almost no one was prepared for. Going forward, at least for now, Europe and Asia seem poised to get back to a semi normal way of life until a vaccine is widely available. But, of course, it’s impossible to predict what exactly will happen or how markets may respond.

Looking at the fundamentals

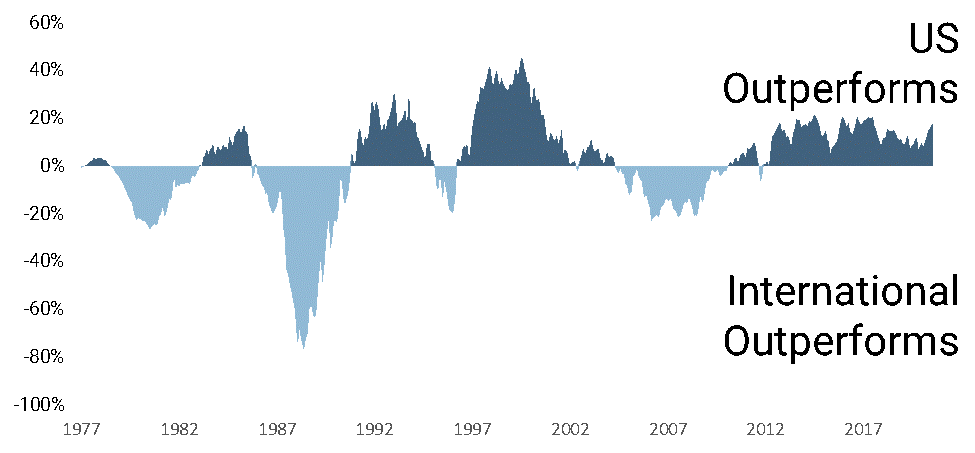

Setting economic and Covid forecasts aside, the fundamentals are also beginning to favor international stocks. Figure 1.2 below depicts the rolling 3-year relative out/under performance of the S&P 500 and the MSCI World ex USA Index. The MSCI index is comprised of large international companies in developed markets such as Germany, England, Japan, and Australia. This chart illustrates the long run oscillating nature of the two broad categories of stocks. Since the late 1970s, both the US index and the International index have enjoyed long periods of outperformance with respect to the other.

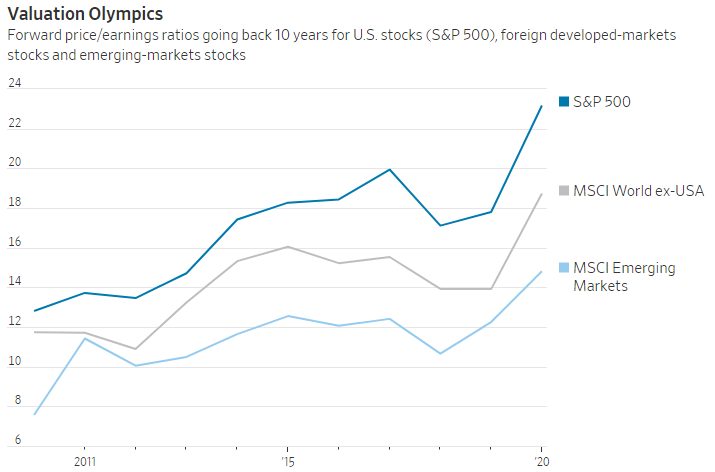

The other conclusion from this graph is that the International index has had a rough go of it for the last 10 years. However, the silver lining here is the current valuation of the respective indices. Figure 1.3 shows the current and historical price to earnings ratios of three different indices. The S&P 500 is currently trading at 23 times earnings estimates, the international developed markets index at 18 times, and even more enticing is the emerging markets index which is currently trading at 14 times.

If you look closely at the chart, you can see that the S&P 500 index hasn’t traded below 15 times earnings since 2013. While Price to Earnings multiples are often breathlessly referenced on CNBC as a reason to sell out of this hot stock and buy into that hot stock, it’s important to consider the fundamentals of what the multiple represents.

A stock’s value is determined by the expected future cash flows that an investor will be entitled to for each share owned. But ratios, such as Price to Earnings, can be used as valuation short-cuts. When an investor has to pay a higher price for the same amount of earnings, the future return of that investment can be expected to be lower. Conversely, if an investor can pay a relatively lower price for earnings, the future return of that investment should be expected to be higher. This dynamic bodes well for international stocks relative to US stocks on a prospective basis.

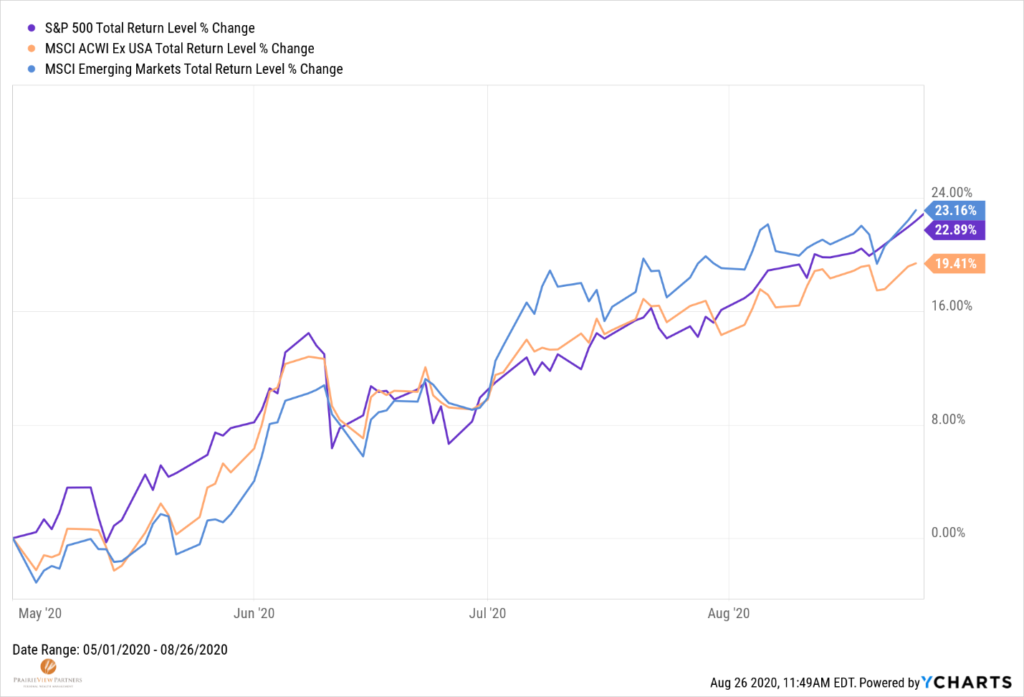

Already, the international indices have started to show some life. Since May 1st, the Emerging Markets index and the S&P have virtually matched each other’s performance. The international developed markets index has also returned nearly 20% in this time period (see figure 1.4).

So, is it time to go all in on international? No! As always, it’s vital to stay invested in all asset classes, and along the way, rebalance to systematically buy what is trading at attractive valuations and be patient until you’re rewarded.

Coming full circle

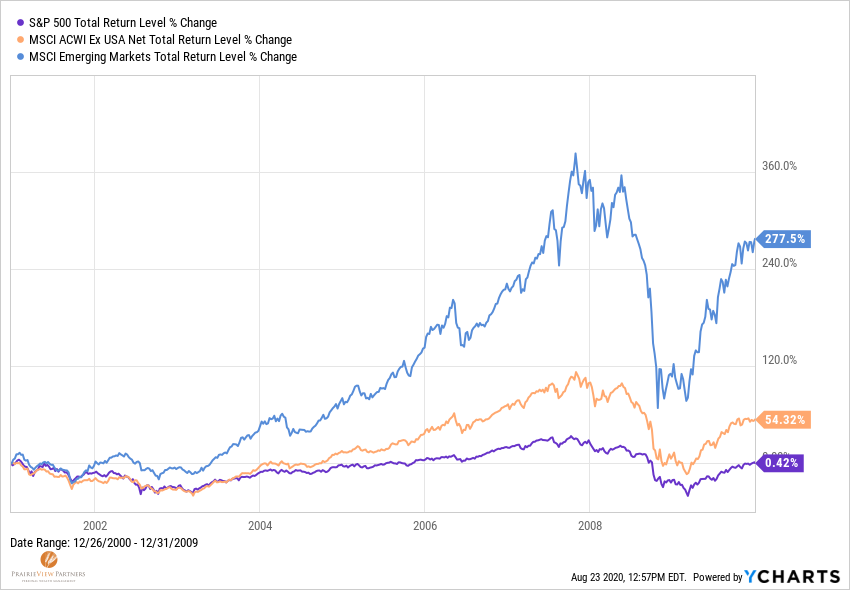

To come full circle to the beginning of this story, the last time the US economy seemed so rock solid may have been at the end of 1999. Stocks of US companies were flying high and stocks of international companies had languished for nearly a decade reaching very low valuations. As expectations for continued US market outperformance took hold, a decade began that saw the S&P 500 post flat returns and Emerging Markets stocks post 200% returns (figure 1.5).

Markets can be stubborn. Markets can stay irrational for long periods of time. Often, they stay irrational for longer than an investor can remain rational. Invariably there will be times when one asset class outperforms another. And their respective fortunes seem to change when least expected.

The temptation is always to sell the loser and buy the winner, but as the track records of active investors show, it is nearly impossible to time these moves correctly. While it has been a long road for international funds over the last 10 years, the combination of attractive valuations and reopening economies may finally mean that it is international’s time to shine. That said, we’ll continue to favor diversification.

Matt Weier, CFA, CFP®

Partner

Director of Investments

Chartered Financial Analyst

Certified Financial Planner®