- April 8, 2025

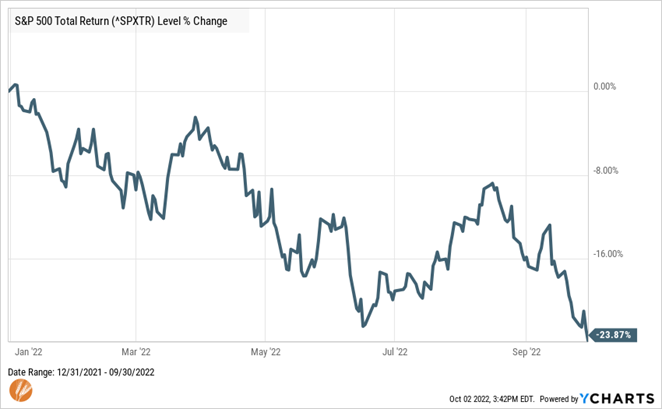

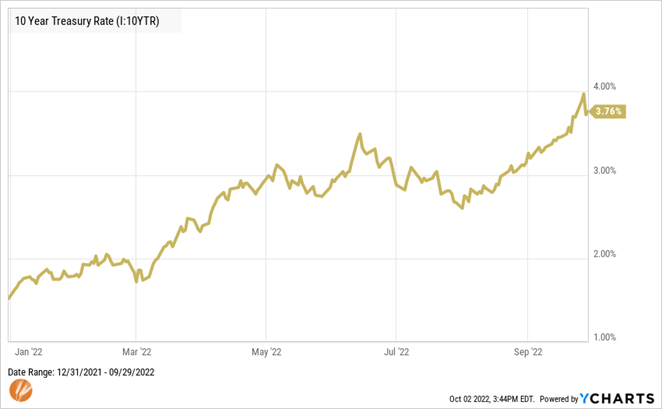

It’s been a difficult year for financial markets. All three quarters this year have experienced negative returns for stock prices, higher interest rates and resulting lower bond prices, and more question marks about the economy. Inflation seems to be sticking around longer than expected and mortgage rates have doubled since the start of the year.

Many of us have been through bear markets before. That doesn’t necessarily make them easier, but maybe it helps set expectations. For some, this may be their first prolonged bear market and have no prior experience to draw from. Regardless of your history with bear markets, it’s natural to seek answers about what might happen next.

Market Predictions are Prevalent

Stock prices. Interest rates. Inflation. Gas prices. If you’re curious what might happen next, an expert is standing by to offer an answer. The economy has been hampered by supply chain glitches, bottlenecks, and shortages in the last two and a half years. However, the supply chain for forecasts, predictions, and “sure things” remains as healthy as ever.

The prevalence of market and economic predictions isn’t unique to bear markets – we had them in 2021, 2020 and every previous year. In 2021 the Federal Reserve forecasted they would raise interest rates once in 2022 using the phrase “lower for longer” to describe their interest rate policy. That one hasn’t worked out so well for them, as interest rates have hiked five times already this year. In one particularly absurd prediction, a prominent investment manager predicted that Tesla stock would reach $4600 by 2026, which would put its market capitalization above Germany’s Gross Domestic Product.

Predictions aren’t necessarily more misleading in bear markets than during bull markets. For every prediction now that stock prices have farther to fall, there was a similar one a year ago predicting how much farther stock prices had to rise.

The trouble is that they catch our attention more at the extremes when the basic feelings of fear and greed are heightened and we’re more likely to seek answers. It’s at the extremes when following a wrong prediction can be most costly. And there are enough “answers” out there to confirm any fear or bias we might have – or to advance the agenda of the expert offering the prediction.

Market Predictions Support Agendas

“Forecasts usually tell us more about the forecaster than the future.” – Warren Buffett

There are enough metrics and data points available to support any thesis or agenda an expert may have when offering a prediction. Unfortunately, the agenda of most experts offering predictions is not their audience’s best interest.

If their thesis is that inflation is going to continue to rise, they can cite residential rental rates or service sector wages. Contrarily, if their agenda is advanced by the notion that inflation will drop, they can cite ocean freight rates, used car prices, or lumber prices. Of note, lumber prices, as observed by the Wall Street Journal last week, have fallen to their pre-pandemic level.

If the thesis is that stocks have bottomed, one can cite how corporate earnings and the labor market remain strong. Someone offering a prediction that stocks have farther to fall can cite the Fed’s latest forecast for continued interest rate increases. As noted above, the Fed’s track record of forecasting their own policy is mixed at best.

Each prediction or agenda is typically followed by a call to action to either capitalize from or avoid the predicted outcome. A sense of control over the outcome is offered through following these calls to action.

Focus on Investment Factors We Can Control

“There are two kinds of forecasters: those who don’t know and those who don’t know they don’t know” – John Kenneth Galbraith

An article by professors Andrew Little of UC Berkeley and Matthew Backus of Columbia University drew the distinction between types of questions. To summarize, they referred to a Level 2 question as one that can be answered by a qualified expert within existing paradigms of study. Examples of this might include, “Can we improve the tax efficiency of an investment portfolio?”, “Can diversification help reduce portfolio risk under various scenarios?”, or “What can past experiences teach us about future expectations?”

They referred to a Level 3 question as those questions where even the best experts don’t know the answers – they are “either not answerable under current research paradigms, or just fundamentally unanswerable.” This is the realm of most market forecasts. It’s also an area where a competent expert, who is well-versed in the relevant literature, may be well-served by saying “I don’t know.” However, saying “I don’t know” is often not the best way to advance one’s agenda, nor does it make for good punditry. So, answers to unanswerable questions are offered.

“The greatest enemy of knowledge is not ignorance; it is the illusion of knowledge.” – Daniel J Boorstin

Level 2 questions tend to be the most useful when thinking about investing for the future. The image below illustrates the investing factors that are in our control, which also tend to be those that are most impactful to our investment outcomes as long-term, goal-focused investors. The other topics are certainly interesting and can have an impact on results. But, since we have no control over them, there is little benefit to the handwringing that often accompanies them.

Unfortunately, the factors that we cannot control are what tend to most influence short-term investment fluctuations and dominate headlines. And we tend to notice them more – particularly at the extremes that we have witnessed this year and the last few. Short-term investment results tend to be reactionary and thus prone to over correcting.

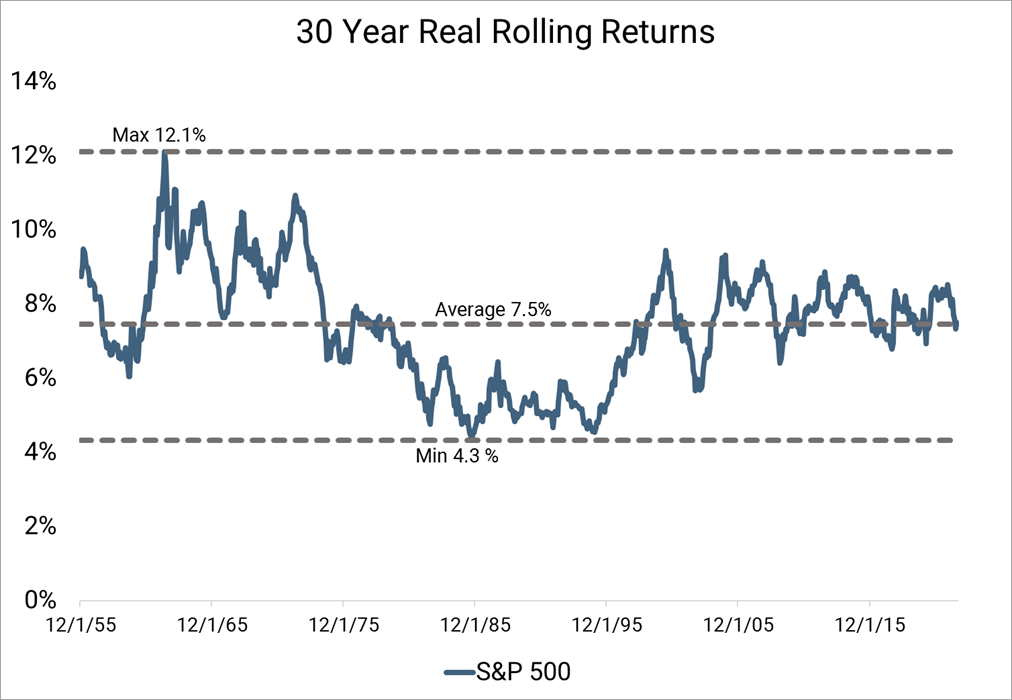

When we focus on the factors that we can control and allow markets the time to adjust course, we’re better able to take advantage of the long-term, wealth-creating power of compounding. Relatively small amounts invested, along with average returns earned over time, can turn into more than thought possible. Maybe you’ve heard the phrase, “We overestimate how much we can accomplish in a year and underestimate how much we can accomplish in ten years or a lifetime.” This is rarely truer than when investing.

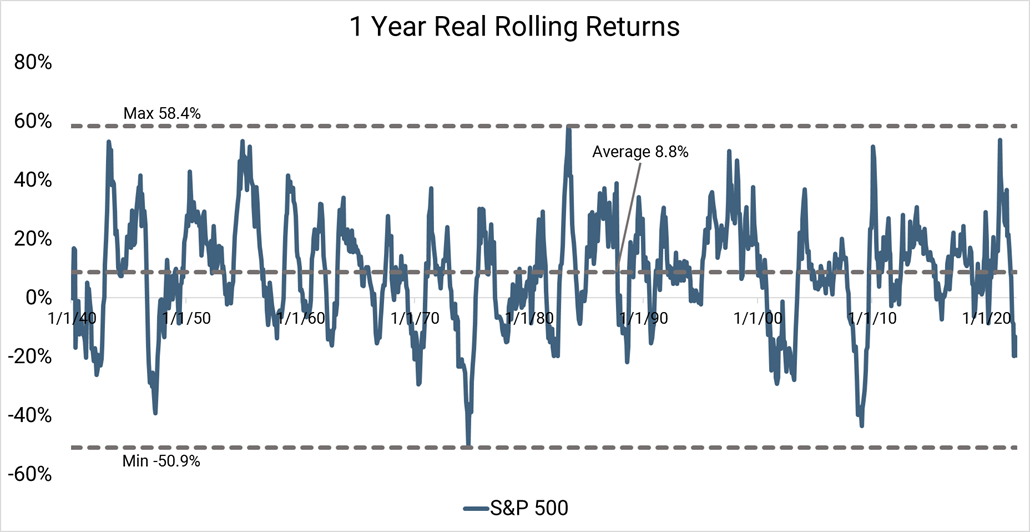

Long-term investment results reflect continued growth in earnings and dividends of the most successful companies in the world. The one aspect of the short-term pattern that is still visible in the long-term is that good returns generally follow more trying times, as well as in the opposite direction. However, the extremes are far less extreme.

Even if good returns are to be followed by this year’s unpleasant returns, trying to answer what will transpire in markets to make that happen and when – the Fed slowing rate increases, the end of military conflict in Ukraine, subsiding inflation, etc. – falls in the realm of a Level 3 question.

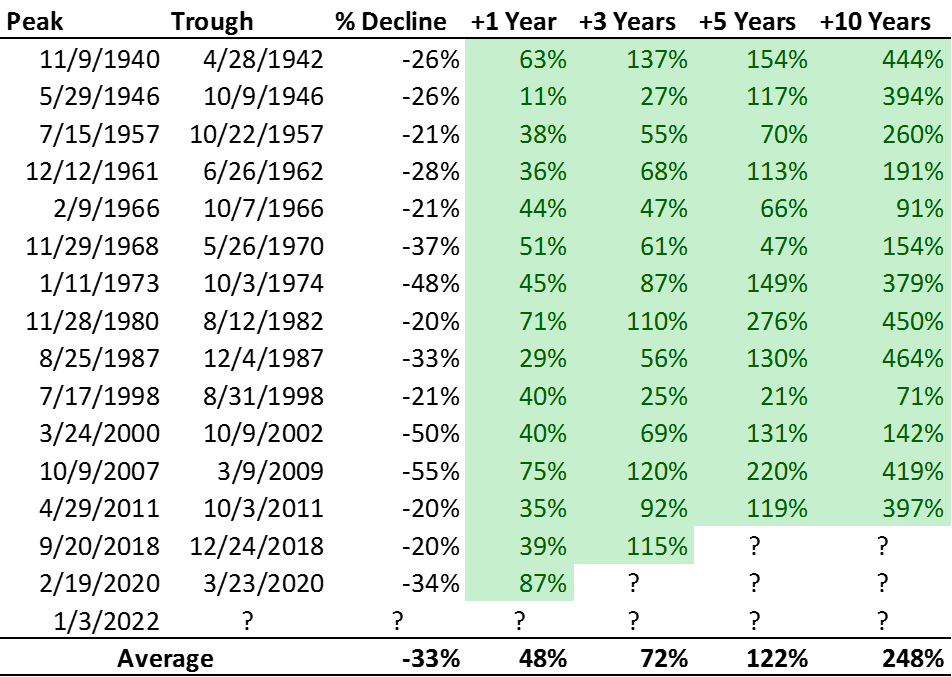

Using Level 2 questioning we can gain a historical perspective of what market returns we can expect following declines like this – regardless of what causes the recovery or precisely when it might happen. I can assure you that regardless of when the recovery happens or what causes it, you won’t want to miss it.

Actions to Take During Difficult Market Times

So, what is one to do while waiting for markets to recover? Even though I wrote here that the best thing to do in a bear market is nothing, I’m going to suggest a few things we can do – but they all focus on the areas in the above image that are in our control.

If you’re young, or not so young, and still accumulating investments – keep doing it! If you have a little extra cash to commit for long-term investment goals, your future return potential is higher now than it was a year ago. Stock prices and future return expectations are inversely related. With stock prices down over 20% this year, the investor opportunity is higher than it’s been in quite some time.

If you’re near or in retirement, remember that while maybe the risk profile of your investments is different than when you were accumulating savings, your investment journey doesn’t end at retirement. Long-term returns are still the most important to your and your family’s financial success. Take a fresh look at the last cash flow plans we discussed and notice that your plans assume you keep living your goals regardless of short-term market conditions.

I was recently sent an article that listed a few actions retirees can take to make the most of the current financial market conditions. It contained several thoughtful tips, but one in particular stood out for me - continue to live out goals regardless of market conditions.

It may not feel like a good time for indulgences but spending on your planned goals is independent of bear markets, or bull markets for that matter. If it makes it any easier to come to terms with the indulgence of a vacation, the euro and the pound are down 14% and 17%, respectively, this year compared to the dollar. I’ve heard Italy is beautiful in the Fall.

Thanks for reading.

Matt Weier, CFA, CFP®

Partner

Director of Investments

Chartered Financial Analyst

Certified Financial Planner®