- July 8, 2025

Well, this doesn’t feel good. Many of us came into 2022 thinking, “This is the year!” The pandemic looked to be easing. Supply chain problems were going to get better so we could get our stuff sooner. Sure, we’ve had some higher-than-normal inflation, but it seemed a decent trade-off for what could have happened to the economy absent swift and meaningful action back in 2020. But this might be starting to feel like “here we go again.”

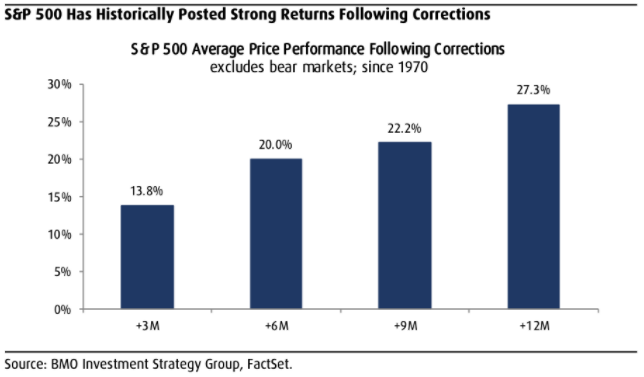

The S&P 500 closed down 10.1% on February 22nd from its last peak – all the way back on January 4th – officially entering a “correction.” That’s fine. Corrections of 10% - 15% come along every year and a half or so. They’re the price we pay for the long-term returns stocks have provided. A less expected outcome would be a repeat of 2021’s 28% positive return. But, given the circumstances of a strong economy, job market and corporate earnings, 2022 was looking pretty good.

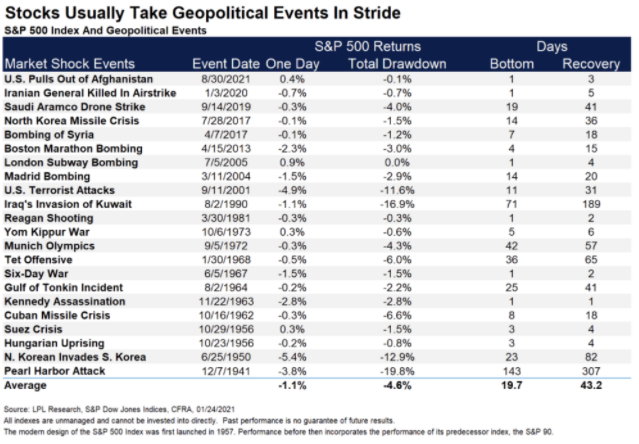

Now this. War in Europe. The S&P closed down 11.7% on February 23rd from the high. Ok, a little worse, but not too different than 10% down. Then markets opened down another 2.5% on the 24th – that might have felt different. That’s getting closer to the lower bounds of what might be considered a “run of the mill” market correction. Understandably, the concern then becomes whether stocks will continue to fall to 20% down or even more. Because that would make sense given the recent geopolitical shock, right?

Not so fast. From their low on the 24th, stocks rallied to finish the day slightly positive and followed that up on the 25th with a 2.25% gain putting them down only 8.3% from their January peak. From an intra-day low of nearly 14% off peak back to only about 8% off peak in two trading days!

This is why making investment decisions based on short-term, uncontrollable factors is so difficult. Things arguably got worse and stock prices rallied. Trying to reconcile this can spin your brain in circles. When stocks are falling it feels like something should be done. Afterall, the talking heads on TV started talking about how to change your investment strategy in response to developments, and how risk management has become more important in light of current events.

That’s not how it works though. Successful investment outcomes don’t take shape during times of crisis or heightened worry. Changing an investment strategy in the face of external, non-controllable factors is not a strategy, it’s a reaction. And the best method of risk management is always to make and implement an investment plan before a crisis that is out of our control happens.

These are the times to stick with your strategy and work the plan. When uncontrollable factors dominate the headlines, it's best to refocus on what we can control as investors.

- Your portfolio’s risk reflects the needs and goals of your financial plan – not the agenda of the expert on TV or in the newspaper.

- If you’re dollar cost averaging into the market – this is what that strategy is meant to benefit from. You’re buying stocks cheaper now than you did a month ago, which helps long-term return potential.

- If you’re drawing from your portfolio, your portfolio reflects those expected withdrawals and the regular occurrence of corrections and bear markets as part of your spending plan.

- For those with taxable investment accounts, we have been “tax loss harvesting” where possible to help save you some taxes this year and potentially in future years.

- If you’re still adding to your savings and investments, keep doing so.

It’s always tempting to think this time it’s different. Sure, the specific events are different, but the fact that there’s always something that can or does cause a decline in stock prices isn’t different – it’s the constant. And the same thing that got us through past crises will get us through this one – working the plan and remaining focused on what we can control.

I’ll close with two sets of statistics. The first chart below shows stocks’ strong track record of recovery from corrections and the second table shows stocks’ history of successfully weathering geopolitical events. Not that market statistics should make us feel better about what is occurring in the world, but my hope is that it at least provides some context for markets considering current events.

Thanks for reading.

Matt Weier, CFA, CFP®

Partner

Director of Investments

Chartered Financial Analyst

Certified Financial Planner®