- November 20, 2024

2025 401(k) Contributions Limits and New ‘Super Catch-up’ Rule

Personal Finance| Tax Planning

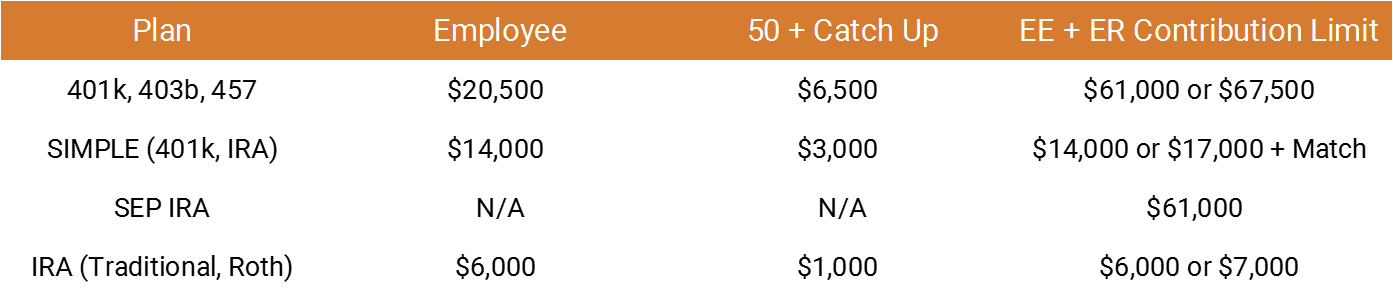

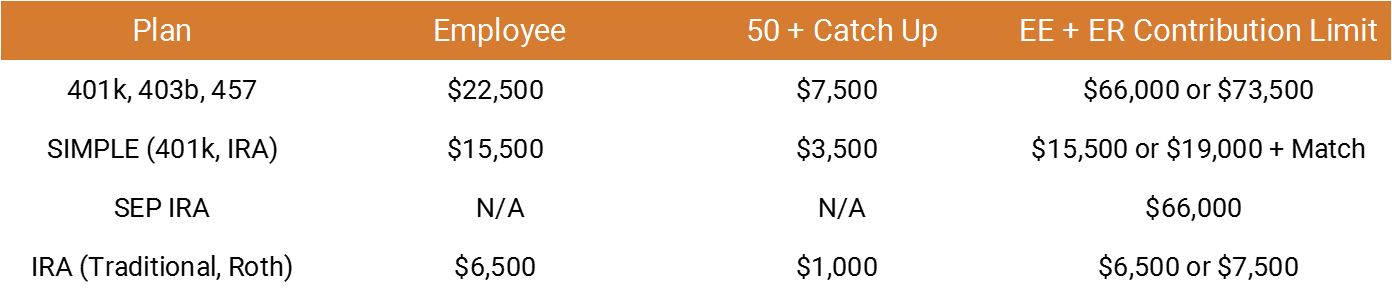

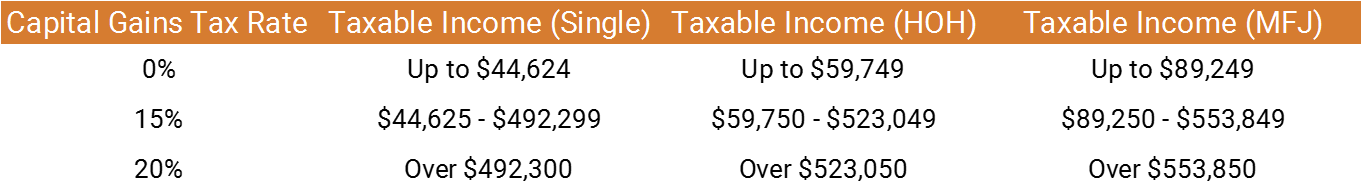

read moreAlthough many of the headlines and news stories we’ve seen have painted inflation as the enemy, there is a sliver lining to recent high inflation rates. High inflation is triggering some pretty big changes to tax laws. Tax brackets, standard deductions, retirement plan contribution limits, among others are receiving large increases to keep pace with inflation. Let’s review the changes coming in 2023 to IRS limits.

*2022 Compensation Limit for employer retirement plan deferral - $305,000

*2023 Compensation Limit for employer retirement plan deferral - $330,000

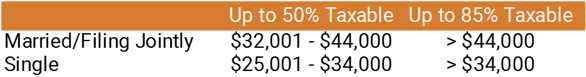

*Above thresholds represent taxpayer's modified adjusted gross income

*2022 Social Security Tax Wage Base - $147,000

*2023 Social Security Tax Wage Base - $160,200

For information regarding our blog disclosures, click here.

Personal Finance| Tax Planning

Personal Finance| Tax Planning

Personal Finance| Tax Planning

Personal Finance| Tax Planning

Let our advisors help clarify your current financial situation and give you a plan for working towards your long-term goals.