Zero commissions. Just straightforward and honest guidance.

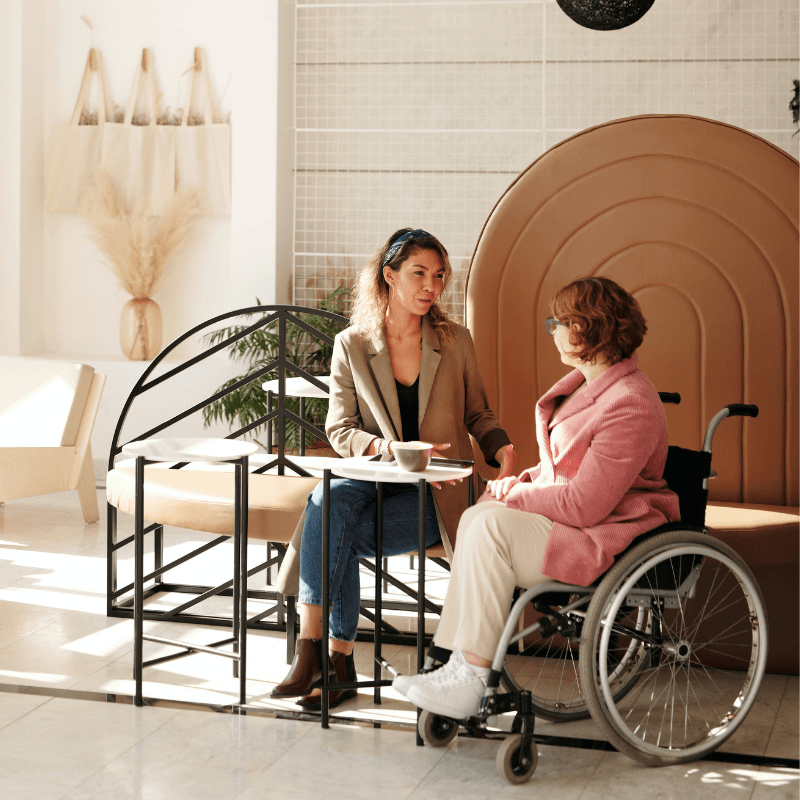

Personal risk management is an important component of any comprehensive financial plan. Although there are a number of ways to control risk, for most people it will involve purchasing insurance. But unlike insurance salespeople, we take your best interests to heart when helping you plan for the future.

We take a different approach to provide you with clear and transparent advice.

The size of potential commissions, in our experience, is often big enough to cloud objectivity. We are knowledgeable enough about insurance products to help you identify and secure appropriate coverage, but we do not sell insurance nor accept commissions.

As a standard part of our financial planning process, we consider what events could jeopardize your family’s wealth. If you have a spouse and/or dependents relying on your earning ability, we assess the need for life insurance.

Similarly, we make sure you understand the need for disability insurance or a long-term care policy. We also look at your liability exposure and suggest appropriate auto, home, professional, and umbrella insurance coverage.

Inflation is falling. The job market is growing. GDP growth is exceeding expectations. We’re actually earning interest on our cash and bonds. And corporate earnings growth is expected to accelerate...

I recently read an article in The Economist that discussed topics related to the current state of journalism. It contained a line that could also apply to market expectations – specifically when...

Interest rates on Treasury securities, money market funds, and savings accounts are at 15 to 20 year highs, hovering near 5%. With stocks now sitting 10% below their previous high from almost two...

Our goal is to make sure you have the right amount of insurance to protect you against loss from the usual and unusual risks you may be exposed to.